That have a 30-12 months repaired-price real estate loan, you have the self-reliance to repay the loan shorter if the it is possible to. But exactly how? As this version of financing offers you the lowest payment alternative, you could in fact end up being financially in a position to pay more than what you owe monthly. Possibly you are able to spend a whole lot more inside September and you will October, but could just pay for the normal payment during the November and December. You can do one. You need to be mindful if your mortgage provides prepayment punishment, and therefore ount of your own loan equilibrium in one single year. A 30-year repaired-rate mortgage try predictable, and offer the sleep well advantage. Knowing your fee will remain consistent makes some thing a little less stressful, and you can makes it much simpler and also make most other financial plans. With this loan, you are sure that that your particular monthly payment are $X. Therefore regardless of the goes wrong with interest rates and also the construction elizabeth. Their fee amount will continue to be lingering. Like that, you certainly can do certain monetary likely to finance whatever else, such as for example educational costs, to purchase yet another vehicle, or bringing a secondary. Your monthly payment can alter should your premium change to suit your taxation otherwise insurance policies.

You only pay way more interest

Their interest rates with the a thirty-year fixed-rate mortgage would be higher, whilst it will continue to be a similar regarding the life of the borrowed funds. If you get a thirty-seasons repaired-rate loan, the financial lender’s threat of not receiving paid down try pass on more than a longer period of time. Thus, lenders charges high interest levels into the funds which have expanded terms. This could look noticeable, but it’s in addition to something you should envision: when you like a 30-season home mortgage label, you’ll spend even more appeal than simply if you decide to favor a shorter mortgage identity. It is that easy. Yes, a 30-12 months fixed-rate mortgage can offer you the low payment, but that’s as the you might be deciding to shell out your loan count back along side longest period of time. So long as you are obligated to pay cash return towards bank getting your loan, you can are obligated to pay focus, meaning you’ll be able to pay even more total focus to your a 30-12 months fixed-rate mortgage than simply you are going to on the an excellent 20- or 15-season fixed-rates financing. Once the in earlier times just before, you have to pay back the loan with the a keen amortization schedule, and this reduces everything you have to pay of course, if your are obligated to pay it. Your own financial gives you that agenda. In addition, it stops working how much cash of each and every of your own repayments is certainly going towards your dominant equilibrium and just how far is certainly going with the your own focus.

30-year-fixed-rate loan: disadvantages

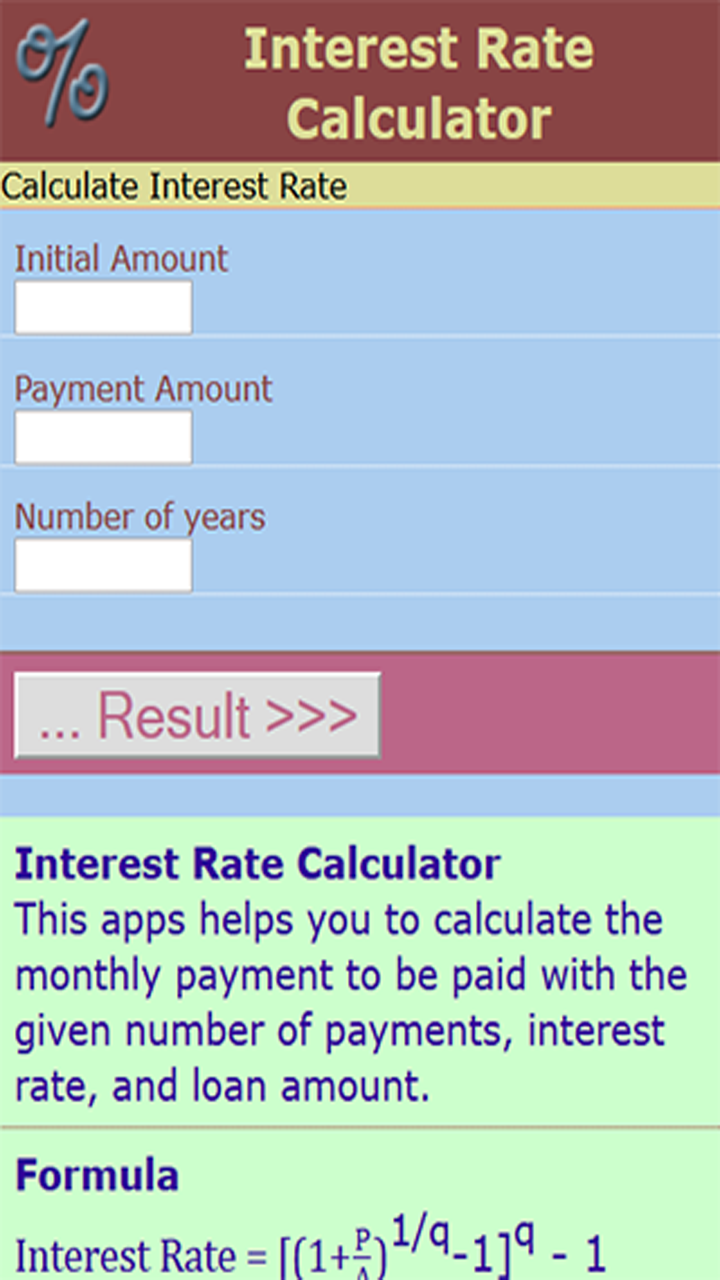

Go with an amortization calculator, which you yourself can discover on the web. Once you plug in a few information about the loan (or perhaps the loan you want), it will direct you how much cash interest you are going to shell out considering the loan’s name.

A 30-12 months fixed-price loan might not complement along with your other lifetime requirements. Maybe you would like the termination of the loan identity plus old age to correspond. This might imply you would like a good 20-12 months financing term, maybe not 29. Will be your objective to obtain the household paid prior to (otherwise alongside) giving your son or daughter over to school? Talking about important things to look at after you favor that loan title. When deciding just what financing words and you can choices are effectively for you, think about exactly how much from a payment your you will be comfortable with. Also consider just what latest interest rates are like, and also the period of the loan identity need. Their home loan can make suggestions from the techniques, and explain the different alternatives available for your debts. A 30-year repaired-price mortgage loan may be the proper mortgage solution to rating your on the family you have always wanted.