Possible homebuyers are facing highest will set you back to invest in a home with an average much time-term U.S. financial price moving significantly more than 7% this week so you’re able to the high height during the almost four months.

The common price into a thirty-year home loan rose so you can seven.1% off 6.88% a week ago, mortgage client Freddie Mac computer told you Thursday. Last year, the pace averaged 6.39%.

When home loan rates increase, they are able to create a lot of money 1 month inside the charges for individuals, limiting how much they are able to pay for at once when the You.S. housing industry remains constrained from the relatively few homes for sale and rising home prices.

Due to the fact prices trend highest, potential real estate buyers try determining whether or not to buy ahead of costs go up even much more loan places Ashford or hold off in hopes away from Khater, Freddie Mac’s chief economist. Last week, get applications flower sparingly, nonetheless it remains unsure just how many homeowners is also withstand growing cost afterwards.

After climbing to a beneficial 23-season a lot of eight.79% in Oct, the common price into the a 30-season mortgage had remained below eight% since very early id criterion that rising cost of living create simplicity enough this current year on the Federal Set aside to begin with reducing their small-term interest rate.

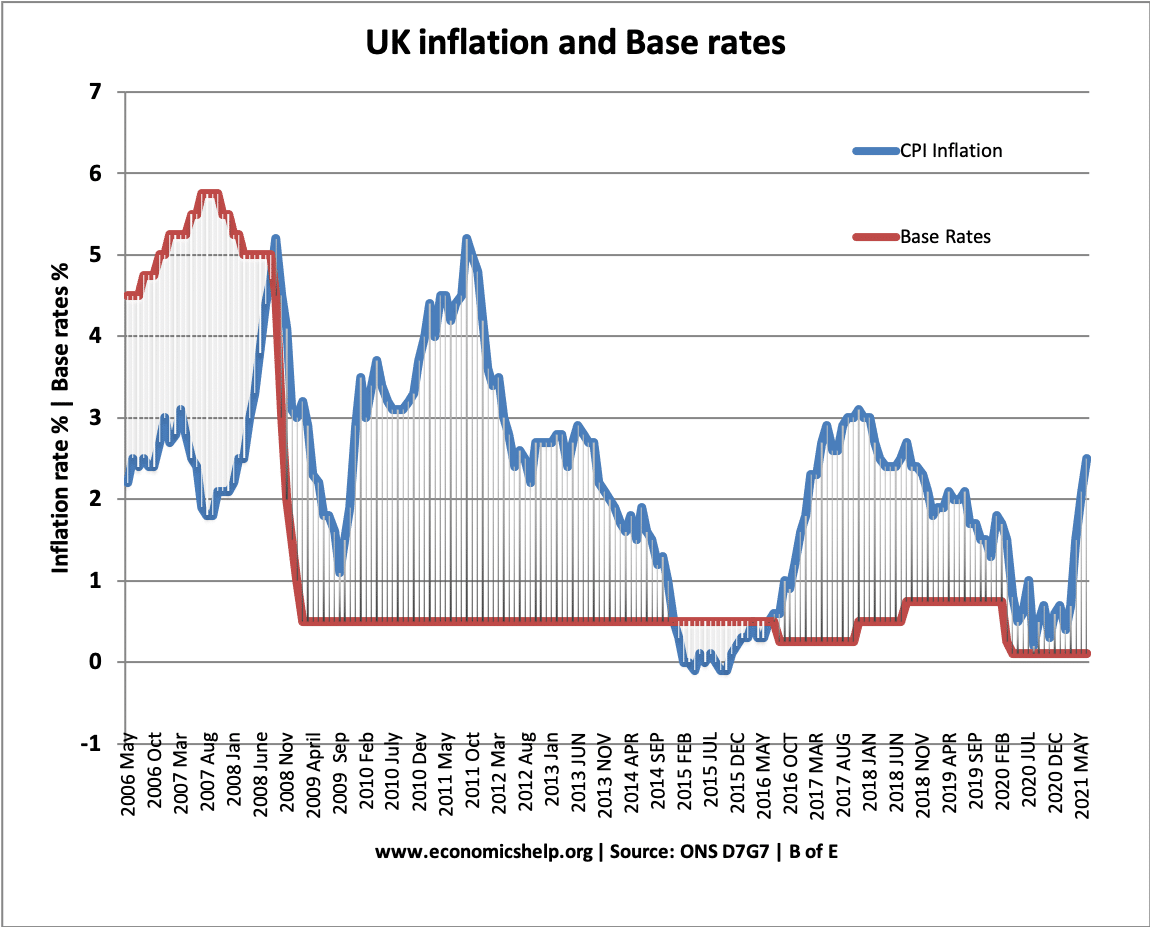

Mortgage rates are affected by several activities, together with the thread industry reacts into Fed’s interest plan therefore the actions on 10-year Treasury produce, and this lenders fool around with as a guide to costs lenders.

But home loan pricing was in fact mainly drifting highest into the previous days since stronger-than-requested account to your work and you will rising prices have stoked second thoughts more just how in the near future the new Provided you will plan to begin decreasing their benchmark notice rate. The latest uncertainty has actually pressed upwards thread returns.

Brand new produce to your ten-year Treasury jumped to around cuatro.66% for the Monday – its high height while the very early November – just after finest authorities on Government Reserve recommended the main financial get keep its chief desire constant for a time. The fresh Given wants to attract more trust you to rising cost of living is sustainably heading towards the their target of dos%.

The produce is at cuatro.64% during the midday Thursday shortly after the fresh new study to your software getting jobless benefits and you may a research demonstrating creation development in the new mid-Atlantic area directed so you can a more powerful-than-asked U.S. benefit.

Without cuts with the federal loans rate forthcoming along with the new savings nonetheless strong, there isn’t any need observe downward tension for the home loan pricing now, told you Lisa Sturtevant, captain economist on Vibrant Mls. It appears to be even more possible that financial costs are not going to go lower any time in the future.

Sturtevant told you chances are the common rates to the a thirty-12 months financial commonly hold alongside eight% throughout the springtime in advance of easing towards the mid-to-large 6% range into june.

Almost every other economists plus assume that home loan cost often simplicity modestly afterwards in 2010, that have forecasts fundamentally calling for the average rate to remain a lot more than 6%.

Home loan cost have finally grown about three days in a row, a drawback getting domestic consumers this spring homebuying seasons, traditionally brand new casing market’s busiest season.

Sales away from previously filled You.S. home fell last month once the household consumers contended having elevated mortgage rates and you will rising cost of living.

Whenever you are easing mortgage cost assisted push household conversion process large inside January and you will February, the average speed towards a 30-12 months mortgage remains better a lot more than 5.1%, in which was only 2 years ago.

One large gap anywhere between prices on occasion enjoys aided limit the number of previously filled land in the business as the of a lot property owners which ordered or refinanced more than two years in the past is reluctant to offer and present up their repaired-speed mortgage loans lower than step three% otherwise cuatro%.

Meanwhile, the price of refinancing a home loan including got pricier which times. Borrowing from the bank will cost you into 15-year fixed-speed mortgage loans, tend to accustomed re-finance expanded-label mortgages, rose recently, pushing the common rates so you can six.39% from six.16% a week ago. This past year it averaged 5.76%, Freddie Mac computer told you.

Oregon a home

- Rogue Valley’s most advanced drink holiday is actually for sale at $9M

- Indie rocker and you can musician promote long time Portland mansion. Comprehend the dramatic interior

- 1907 Foursquare house for the NE Portland obtainable at the $985,000. Discover inside

- French-build mansion near Waverley Country Pub for sale during the $5M

- Average mortgage rate presses highest having first-time when you look at the eight months

If you buy something or sign up for an account courtesy a link towards the the website, we would located compensation. Applying this site, your consent to the User Arrangement and agree that your clicks, connections, and personal guidance are compiled, recorded, and/or held by us and you will social media and other 3rd-people partners in accordance with the Privacy policy.

Disclaimer

Usage of and/otherwise subscription with the any portion of the website constitutes welcome of all of our Representative Arrangement, (updated 8/1/2024) and acknowledgement of your Privacy, and your Privacy Possibilities and you can Legal rights (updated eight/1/2024).

2024 Get better Local Mass media LLC. All the liberties arranged (From the United states). The information presented on this website may not be reproduced, distributed, carried, cached or else utilized, but on the early in the day created consent regarding Get better Regional.