- ?? Month: Displays the fresh respective week of each and every entry.

- ?? Principal (?): Indicates the amount used on the loan prominent.

- ?? Interest (?): Portrays the attention element of their payment per month.

- ?? Total Payment (?): Means the general fee made each month.

- ?? Pending Amount (?): Reflects the rest count in your mortgage after each fee.

In the world of private money, fund are a necessary methods to go our very own desires, whether it is to get another vehicles, acquiring an aspiration domestic, otherwise conference immediate personal need. However, this type of finance have the responsibility out-of Equated Monthly payments (EMIs) – normal repayments you to definitely influence your financial relationship. Luckily, EMI hand calculators, the fresh new unsung heroes away from monetary think, exist in order to clarify the complexities ones money.

A keen EMI calculator was a digital genius one works out your own monthly EMI debt having eye-popping accuracy and you can price. It is a benefit for those navigating the industry of fund, providing a publicity-100 % free means to fix dictate your own monthly monetary responsibility. Should it be an auto loan, home loan, otherwise personal bank loan, EMI calculators focus on individuals financial need.

Step Very first

Start by going into the loan amount you want to obtain, the rate provided by your bank, and period or years more you intend to repay the mortgage. This post is crucial because it will assist the fresh new calculator influence your own month-to-month fees together with overall cost of the financing.

Action Next

Immediately following every required areas is occupied within the, the newest calculator have a tendency to quickly generate the fresh projected EMI (Equated Monthly Installment). Additionally understand the overall interest payable along the financing title and overall number you will need to pay-off. This provides you with a clear report about debt union.

Step 3rd

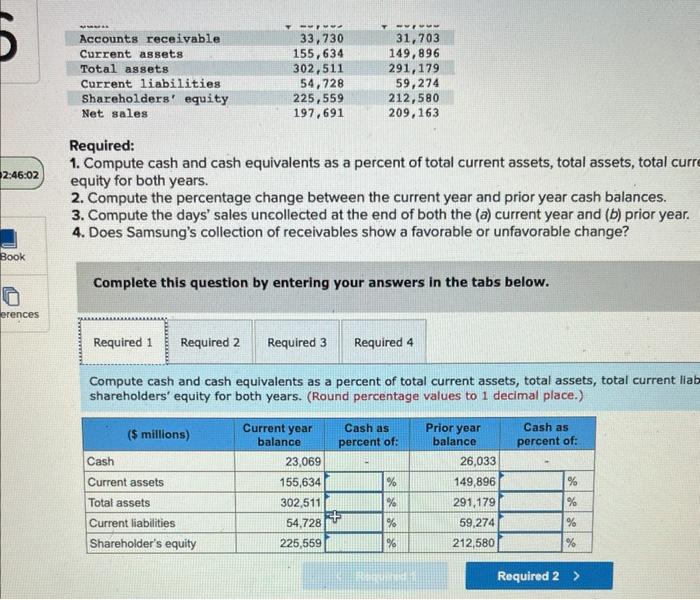

Shortly after calculating, an in depth amortization dining table is done less than. Which table reduces for every payment per month into the principal and attention section. In addition, it suggests exactly how much of financing harmony stays once for every fee, providing an obvious view of their payment progress through the years.

Understanding the Miracle At the rear of EMI Calculations

EMIs (Equated Monthly obligations) put a few main areas: the primary loan amount while the notice levied of the bank. The entire EMI would be determined utilizing the algorithm lower than:

The key benefits of Using EMI Hand calculators

2. Time-Saving: Tips guide EMI calculations is going to be big date-drinking and prone to problems. EMI calculators create instantaneous results, helping you save precious time and energy.

3parative Investigation: EMI calculators enable you to examine several loan possibilities, letting you create informed decisions according to debt capabilities and you can expectations.

5. Transparency: By using a keen EMI calculator, you will get understanding of the loan cost procedure, which is invaluable getting proper monetary think and you may goal setting techniques.

Examining the Version of EMI Calculators

- Amount borrowed: Input the total price of the car, including taxes and extra fees.

- Interest rate: Establish this new yearly rate of interest provided by the financial institution.

- Financing Period: Choose the course more than which you propose to pay the borrowed funds.

- Loan amount: Go into the total cost of the property and you may any supplementary expenses.

Strategies for Using EMI Calculators

2pare Has the benefit of: EMI hand calculators enable you to contrast financing offers from individuals loan providers, assisting you to in finding the most suitable solution.

cuatro. Limited Prepayments: Use the EMI calculator to evaluate the perception of fabricating limited prepayments on your loan, which can lower your full attract burden.

5. Glance at Mortgage Tenure: To improve the loan period throughout the EMI calculator to discover the best harmony anywhere between down EMIs and you may shorter loan repayment.

Conclusion

To summarize, EMI calculators are very important gadgets for everyone provided car and truck loans, home loans, or signature loans. They supply reliability, time discounts, and you may active economic think. Of the grasping just how these types of calculators work and you will applying the latest considering tips, you are able to well-advised behavior about your financing, straightening them with your financial goals.

Regardless if you are gearing to purchase your fantasy auto, invest in a home, or address individual need, EMI hand calculators was online personal loans no credit Minnesota your trustworthy friends with the travels to the economic empowerment. Use these hand calculators judiciously, and you will probably select mortgage fees an easier plus in balance undertaking.

The user-amicable program enables you to to evolve financing numbers and you can tenure, to tailor your EMI on the certain requires. This valuable unit helps you imagine monthly installments, total interest will set you back, while the full amount it is possible to repay. With the EMI Calculator, you can with confidence policy for debt upcoming.