Article Notice: The message of the blog post will be based upon the newest author’s opinions and you can advice by yourself. It might not was basically reviewed, commissioned or else recommended of the any one of all of our community partners.

For almost all consumers, to shop for property which have home financing backed by this new Government Housing Administration (FHA), called a keen FHA loan, renders homeownership in an easier way and sensible. These types of money basically give reduce fee and you may credit history conditions to consumers just who meet the requirements.

The latest FHA loan limit having an individual-house in the Virginia is now between $420,680 and $970,800, with respect to the condition. The reduced limit pertains to inexpensive rural portion, whenever you are consumers looking land in the area from the north a portion of the county close Washington, D.C may be eligible for high limitations.

Exactly how are FHA financing limits calculated?

The brand new U.S. Department of Property and you may Metropolitan Advancement (HUD) set limitations from year to year about most of a beneficial house’s costs the newest FHA are happy to ensure in any county on the You.S. This type of constraints are based on the brand new compliant loan constraints which come which have old-fashioned mortgages.

FHA funds enjoys both a floor and you may good threshold. The floor ‘s the biggest mortgage the fresh institution have a tendency to insure for the every U.S.; its calculated since 65% of conforming mortgage restriction. The fresh roof is applicable only to large-costs section and is computed just like the 150% of your own restrict. For the majority of the country, the newest FHA loan restrict have a tendency why not look here to slip approximately the floor and you will this new threshold, according to casing cost and you can build costs where urban area. Home prices expanded 18% from 2021 so you can 2022, so limitations both for compliant and FHA loans went right up because well.

FHA funds usually are so much more flexible than antique fund in the event it concerns credit scores and downpayment quantity, so they bring a chance to get a house less and which have less cash. Still, there are certain FHA financing criteria. If this sounds like very first big date to shop for a house, you could be eligible for even more help with certainly Virginia’s first-day homebuyer software. They give programs to help with the newest borrowing process too due to the fact money instance very first-go out homebuyer taxation credit and you may advance payment recommendations.

To be eligible for an FHA loan, you’re going to have to use according to the loan limitation your location and also meet up with the adopting the criteria:

- A credit history out of five-hundred or maybe more. To sign up for a keen FHA loan, individuals have to have a credit rating of at least five hundred. That have a traditional financial, minimal score is 620.

- A downpayment off step 3.5% or maybe more. If for example the credit score was at minimum 580, you may also be eligible for good step 3.5% advance payment. That have a diminished credit rating, 500 in order to 579, you’ll need to build a good 10% deposit.

- Financial insurance policies. Extremely FHA financing need individuals to expend one another an initial home loan premium (UFMIP) and you can an annual financial top (MIP). The UFMIP are step 1.75% of complete loan amount and will getting folded on the financial. This new MIP selections from 0.45% to a single.05% of loan which is dispersed anywhere between several monthly payments which you’ll fundamentally are obligated to pay into the lifetime of the mortgage.

- A loans-to-earnings (DTI) proportion away from 43% otherwise shorter. Normally, FHA mortgage consumers cannot possess an excellent DTI that exceeds 43%, though some lenders allow for exceptions.

- Household must be a first household. Individuals are required to utilize the house because their top house for around one year once get. You can’t play with an enthusiastic FHA mortgage to find a second house or money spent, unless it’s an excellent multifamily assets and also you propose to inhabit one of several tools.

- An FHA family appraisal. The FHA possesses its own advice to own appraising a house, no matter what house’s purchase price or even the advance payment number.

To shop for an effective multifamily property having an enthusiastic FHA financing

It’s possible to pick one-house having a keen FHA loan and additionally a beneficial multifamily house with 2 to 4 products so long as you real time in one of the systems for at least 12 months after pick. Assume a similar down payment criteria, that have accredited buyers entitled to lay just step three.5% off. A supplementary work with: Whether your agreements are residing in one of the gadgets for one year, you might be able to use their requested book to simply help you qualify for the borrowed funds.

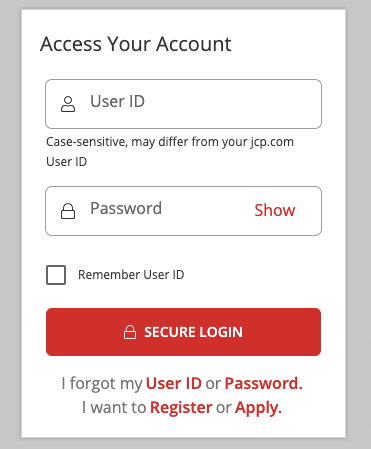

FHA lenders into the Virginia

If you are searching getting an FHA financing within the Virginia, listed below are eight highly regarded loan providers. Click on the labels to see the full comment.