Advertiser Disclosure: Feedback, ratings, analyses & pointers certainly are the author’s alone. This article could possibly get include backlinks from our business owners. For more information, please find the Advertisements Rules .

You can find positive points to refinancing the Va Financing, along with a lowered payment, finest terminology, and you can possibly to be able to repay their Va Mortgage a great deal more quickly.

Your credit rating is one of the most very important things to thought after you affect re-finance their Virtual assistant Financing, however it isn’t the simply factor.

How Fico scores Impact Refinancing a good Va Loan

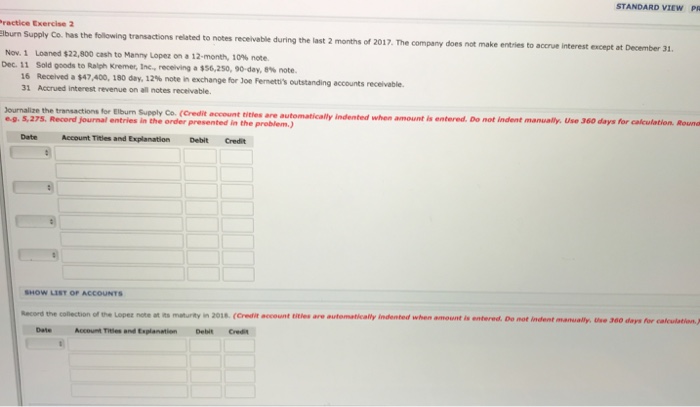

The original question that frequently pops into their heads with regards to a great Va Mortgage re-finance is exactly what credit score is needed to qualify into the financing.

Really mortgage brokers contemplate additional factors whenever giving a beneficial refinance application. These affairs include the debt to help you income ratio, credit rating, while the amount of house equity, or control you may have.

Having said that, generally speaking, the greater your credit score, the low their interest rate, as well as the easier its so you’re able to re-finance their Va Loan.

Let us consider how your credit score influences the capability to re-finance their home loan, and look at another issues lenders examine once you refinance your property.

You want good credit

As for the credit score needed to re-finance an effective Va Mortgage, there isn’t a-flat floors. The fresh new Virtual assistant does not have any one difficult standards getting credit scores, it is therefore up to the lending company you are working with.

While there is no minimal credit rating required to re-finance your own Va financial, most lenders want a credit history off 620 or more. As well as, the higher your credit score, the simpler it is as accepted for your refinance, together with ideal your rates might possibly be.

Whether your credit history actually high, then you certainly should try to improve your credit rating before you apply for installment loans Victoria MS a home mortgage refinance loan, which will help alter your odds of having your Va Financing re-finance approved.

Loans so you’re able to Money Ratio

The debt to help you money (DTI) proportion signifies the latest percentage of the latest monthly gross income that happens towards investing the fixed expenses eg costs, taxation, costs, and you can insurance premiums.

Lenders make use of your DTI proportion once the indicative of cash move observe how what percentage of your revenue is certian towards the fixed can cost you. Such as for example, extremely loan providers don’t want to visit your obligations in order to income proportion exceed over in the ⅓ of overall income.

Discover certain push area with this count, according to private facts. But how much hinges on the financial institution. Therefore you should shop around whenever deciding on re-finance your own financial.

Lenders explore different criteria to possess financing and you may refinance approvals, nevertheless procedure to remember are a lowered DTI proportion is much better than a high DTI proportion.

Credit rating

Your credit score is actually a primary meditation of one’s credit history. Loan providers use your credit rating to verify how well you’ve got addressed credit in past times.

Several imperfections may well not harm your odds of an excellent Va Loan refinance, particularly if they happened a few years ago. not, the latest credit rating try weighted far more heavily than simply elderly credit history. If you involve some previous borrowing from the bank items, it will be best if you cleanup your borrowing from the bank background for a few weeks before you apply for your new loan or seeking refinance your home.

Domestic Collateral

The greater this new percentage of your residence you possess, the easier it can be to obtain acceptance for a great refinance mortgage.

Lenders typically prefer the manager to possess to 20% domestic equity before they agree a home mortgage refinance loan, but this isn’t a hard code with all of lenders. This might be plus alot more real that have refinancing antique mortgage loans than the Virtual assistant Loans, which don’t need an all the way down-payment.