Every single day average home loan cost has just decrease so you can 6.34%, a reduced getting a 30-season repaired mortgage given that . Pricing features since the ticked upwards quite, however they are still nearby the low top in more a beneficial year. This tall drop-off opens up an important concern having property owners: Ought i re-finance my financial?

With rates today below they’ve been for the days, of many residents have a prime standing in order to revisit their economic plans. Refinancing on a lowered price could result in nice deals into the monthly installments and relieve the entire appeal paid off across the existence of the loan.

So you’re able to know if refinancing ‘s the proper circulate, that it Redfin post will mention the benefits, can cost you, and you will considerations inside.

Determining ranging from renting or purchasing your second house?

For folks who ordered your property during a period of high notice costs, refinancing now is advantageous due to the fact prices possess decrease. New rule of thumb would be to re-finance your own financial whenever attract costs is at the very least step 1% below your current speed. not, this might be only both possible. Considering your unique disease, it could be dig this beneficial so you can refinance whenever interest levels are simply 0.5% lower, otherwise it will be far better wait until rates is actually more step 1% lower than your existing price.

While this may seem like a small modifications, it does trigger nice much time-label offers. A lower rate of interest can cause smaller monthly payments, a more quickly benefits of the financial, and even the chance to make use of home security for further financial demands.

Be sure to continue a near observe on the most recent home loan pricing about refinancing to ensure you create probably the most told decision. If you’re considering refinancing your home financing, Redfin’s in-home mortgage lender, Bay Collateral Lenders is a superb kick off point. Get in touch with them to explore your options and determine when the refinancing is actually the best choice to suit your condition.

The vacation-actually area

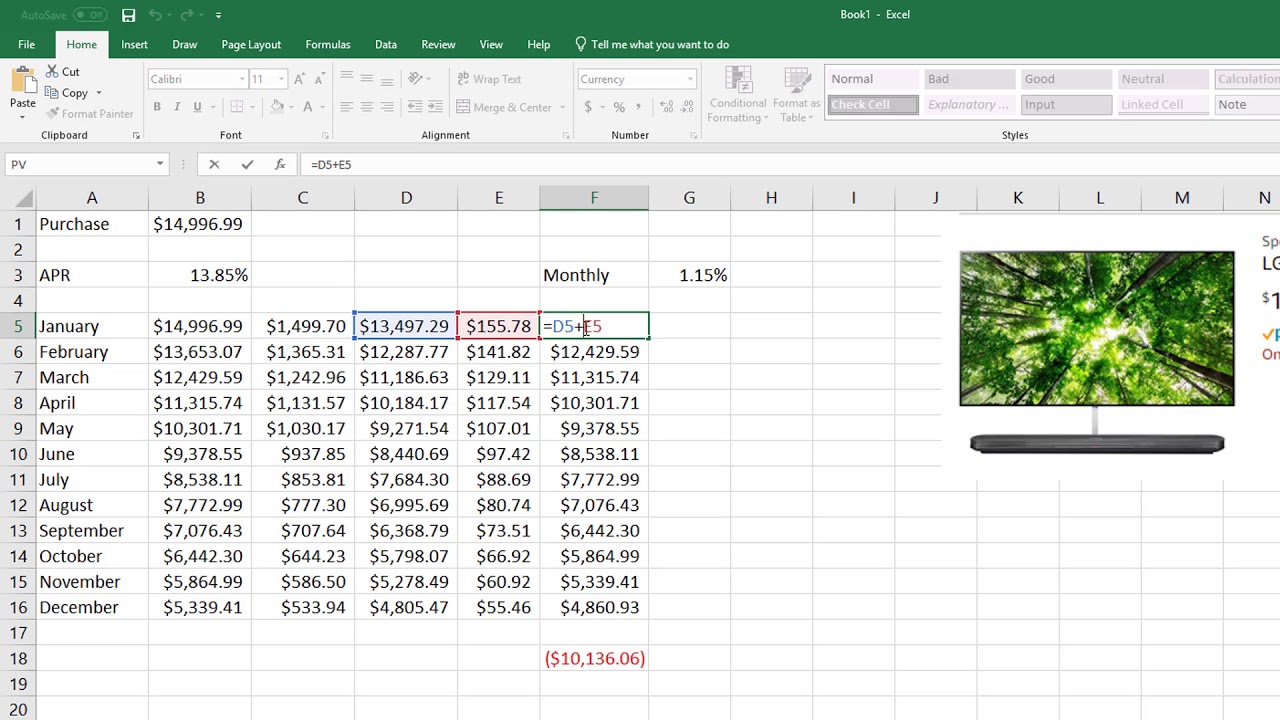

Your own split-also section is when you’ll recover most of the closing costs that include refinancing the loan. Eg, whenever the financial institution and you may identity fees is actually $5,000 as well as your monthly offers off refinancing was $200 30 days, it might grab twenty five months to breakeven.

As a whole, residing in your existing house is finest until you reach finally your break-even suggest make sure refinancing is really worth they.

Just how much longer you plan to reside your home

If you find yourself refinancing the financial, among the first facts to consider is when longer we want to stay static in your home. Think of when your current house have a tendency to fit your life during the tomorrow. If you’re near to performing children otherwise that have a blank colony, therefore re-finance now, there’s a go you will simply stay in your residence to own a short while to-break actually to the will set you back.

Your credit rating

For people who recently took aside an alternate mortgage or produced a late fee, your credit score may have gone down, which means it might not be the ideal time and energy to re-finance. Essentially, the greater your credit score, the lower their attention. Extremely loan providers wanted that consumers features a minimum credit score out of 620-670. Before you re-finance, ensure that your credit score has increased or resided the same, and you meet their lender’s lowest standards.

Should i refinance my personal domestic? Final thoughts

In the course of time, determining whether to refinance your own financial relies on a selection of issues, together with your latest interest, the expenses from refinancing, along with your a lot of time-identity monetary wants. That have recent prices losing and also the possibility of next declines, now can be an enthusiastic opportune time and energy to think refinancing.