Bankruptcy can push possible people adjust its plans, however it does not have to help you-specifically for veterans and you will energetic obligations employees.

cuatro Information Virtual assistant Mortgage brokers and you can Personal bankruptcy

- Just how to Meet the requirements Shortly after a chapter 13 Bankruptcy proceeding

- How exactly to Meet the requirements Immediately after a chapter seven Case of bankruptcy

- An approach to Change your Credit rating

- Ideas on how to Be considered Immediately after a foreclosure

Virtual assistant resource when it comes to a mortgage is administered because of the the new Company of Veteran’s Things, nevertheless the home loan in itself originates from an exclusive lending company otherwise an organization bank. However, an effective Va mortgage differs from a normal financing in lots of ways. In the place of a conventional financing, a beneficial Va financial was supported by government entities. In the event your Va borrower non-payments toward loan, the us government often make up the borrowed funds lender to own part of the loan amount. This means that a loan provider or mortgage servicer confronts faster risk inside the stretching a mortgage so you’re able to a good Va buyer. They can provide pros and you will provider participants into best possible terms and conditions of month-to-month mortgage repayment wide variety, the interest rate, in addition to financing percentage.

Va home loans act like USDA finance and FHA funds, though the latter one or two is targeted at home buyers out-of minimal economic setting. And while Virtual assistant finance aren’t specifically designed to offer homes having a borrower with faster money, they are intended to offer easier mortgage acceptance for armed forces pros and you can effective obligation professionals in return for the assistance rendered to possess the nation.

What’s Bankruptcy proceeding?

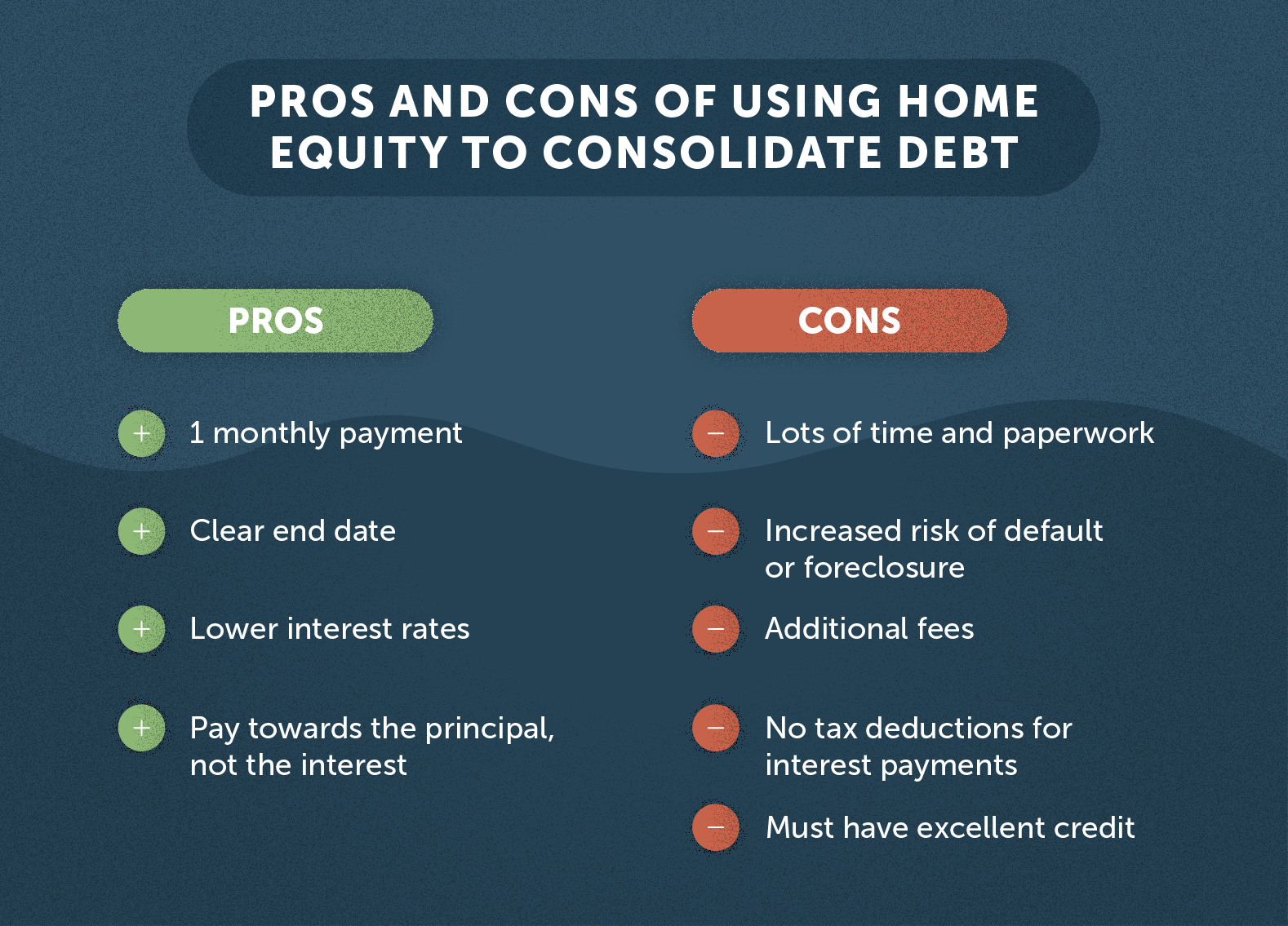

Bankruptcy proceeding was an appropriate techniques it’s possible to go through to find rest from expenses they can not pay off. Although these types of expense are from numerous source, the most used severe occurrences and ongoing crises that can cause bankruptcy proceeding is medical expenditures, layoff, terrible access to borrowing, and you will split up.

You’ll find different varieties of bankruptcy, however, after the case of bankruptcy procedure could have been complete, anyone(s) just who submitted to possess case of bankruptcy get its bills discharged, with many exceptions instance bills having loans obtained less than untrue pretenses otherwise from taxes, student education loans, alimony, and child assistance.

Although not, bank card costs, home loans, and you may automobile financing are several personal debt sizes that’s cleaned away, unless one should choose so you can reaffirm a number of the financial obligation-something which dishonest creditors may try to trick the newest filer on creating. In a number of version of personal bankruptcy, a bankruptcy proceeding trustee will help brand new filer exercise a fees plan so they can maintain its assets. Following its conclusion, the remainder personal debt will be forgiven otherwise discharged.

Immediately after such costs was basically discharged, the individual exactly who registered having personal bankruptcy can start to repair their money and their credit history. It requires on step one-three years before somebody who provides registered to have personal bankruptcy tend to qualify for a more impressive version of obligations instance a home loan. Before this, a credit history regarding any borrowing from the bank agency will show the new case of bankruptcy processing inside their recent history, and additionally they might not have but really indicated so you can possible personal loans online Utah loan providers you to definitely he has got the fresh new monetary solvency to look at the responsibility regarding a payment having a home.

Ought i Rating an excellent Virtual assistant Financial Immediately following Case of bankruptcy?

You can now score a mortgage once personal bankruptcy, delivering he has got enhanced their credit history, enhanced its spending designs, and certainly will showcase financial solvency. It essentially requires ranging from one 3 years in advance of an enthusiastic institutional lender such as a bank could be comfortable offering eg good individual a massive mortgage such as home financing. Nevertheless the great news is the fact its less difficult getting a great experienced otherwise active duty services user so you can safer home financing after bankruptcy proceeding because the bounce-straight back returning to an effective Va financing was less.