Specific homebuyers make use of the framework to cease providing good jumbo mortgage or even to funds a home that needs a higher off fee (eg a residential property).

Exactly how piggybacking is end jumbo money

By the definition, a conforming financing pursue assistance set from the Federal national mortgage association and you may Freddie Mac. Compliant fund should be within this local mortgage limits set by the these types of organizations from year to year. For example, during the 2024, the newest conforming mortgage limit for the majority of of your You.S. is $ .

A home loan one is higher than which restrict loan dimensions won’t qualify for a compliant mortgage. The buyer would need a great jumbo loan instead. Jumbo finance commonly be more expensive and sometimes provides stricter qualifying guidelines.

In some instances, and then make a bigger deposit can also be force a loan right back within this compliant financing restrictions. If you don’t have the brand new upfront dollars for a larger off fee, an effective piggyback mortgage is the answer.

Because of it analogy, we will state you are to acquire an effective $850,000 family and you have saved up $85,000 to have a down payment. You’d you would like an excellent $765,000 mortgage to invest in other house rate. That is greater than the new compliant financing restrict for most of You.S., meaning this scenario would need a good jumbo mortgage.

Now let us is actually the fresh new piggyback financing, instead. This plan would put a different 5% – $42,five-hundred – on the down payment, cutting your priount so you can $637,500. That is nearly $ten,000 below this new compliant financing maximum having 2022.

piggyback to possess apartments

Additionally it is popular observe this new regularly buy good condo. For the reason that financial prices getting apartments are high in the event the loan-to-worthy of proportion (LTV) of your first mortgage is higher than 75 per cent.

To end using highest costs, condo buyers can get restrict its earliest lien size to 75% of your condo’s well worth. They then make a good ten% deposit additionally the leftover fifteen% is covered from the a good HELOC.

Piggyback loans to possess monetary thought

Piggyback finance provide another type of collection of advantage on one-loan programs: They can be higher level gadgets to own monetary coverage and you can believed. That is because from the piggyback mortgage try arranged. The next mortgage into the a good piggyback is oftentimes a house security personal line of credit (HELOC), which provides you a handy credit origin because the a citizen.

HELOCs are very flexible. It works a lot like handmade cards, giving you the opportunity to obtain around a flat credit restrict, pay off the newest line, immediately after which use again. Because the an extra work with, HELOC rates of interest tend to be below bank card prices. But understand that a great HELOC utilized included in an excellent piggyback financial starts maxed-out, and you may need to pay it down before you can lso are-acquire in the range..

Such as, for people who pay $10,000 to minimize the HELOC equilibrium, you could produce yourself an effective $10,000 examine against the HELOC later and employ the cash to possess any mission. You can pay the HELOC in full and then leave they discover to possess future use.

At some point, constantly after 10 years, you could potentially don’t withdraw funds from the fresh HELOC and may repay people leftover harmony through monthly payments.

Understand that HELOCs enjoys adjustable prices

Like, very HELOCs have variable interest rates. Meaning their rate and payment number can transform from day to help you day, based field criteria. In the event the Fed raises the benchount would raise, too.

A great $40,000 HELOC at the 6% interest would want $268 thirty days; an excellent $forty,000 HELOC on 8% desire would charge from the $335 a month.

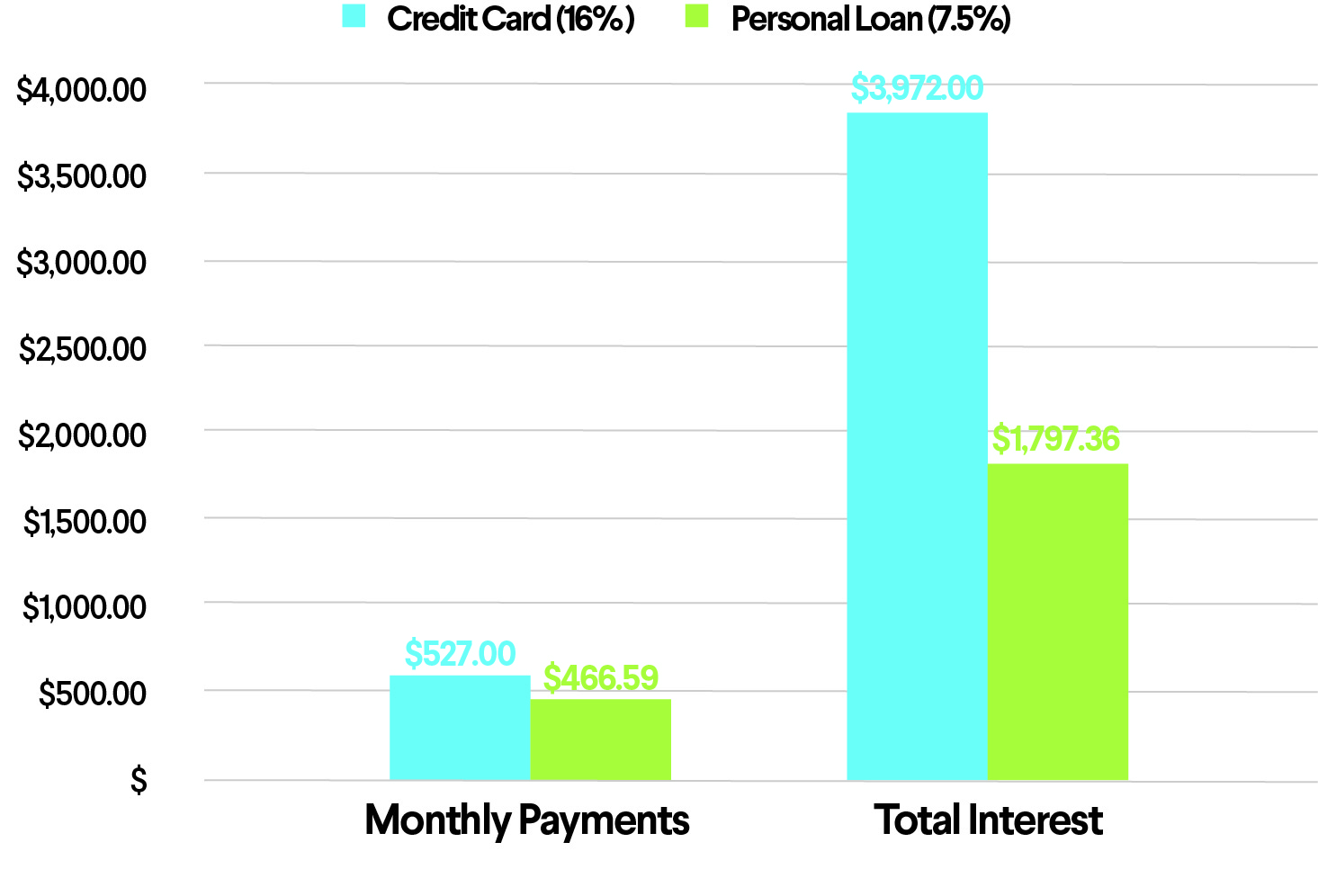

The good news loans in Mosses is that HELOC cost trend far lower than simply almost every other money having variable prices. Therefore they’ve been nevertheless a cheaper source of credit than just credit cards or unsecured loans, such as.