Standard bank increases financing choice accuracy because of the at the very least 50 %

Wescom Borrowing from the bank Connection required an easy way to assess exposure while making behavior regarding the funds for the a wiser, a whole lot more pricing-efficient way. They been successful. That with an analytics-passionate strategy, the firm spared on prospective losings. How? Wescom enhanced the precision regarding credit predicts, simplified the procedure to possess conference regulation standards and enhanced portfolio effect.

The credit union now closely sets the exposure appetite (a measure computed in the cash, which suits risk accounts authorized by the Wescom Panel off Administrators for the credit likelihood of Wescom lending procedures) to their profile risk levels monthly. To help make the top borrowing from the bank conclusion, you have to know most of the areas of your organization, says David Gumpert-Hersh, Wescom Vice president out-of Borrowing from the bank Risk & Econometrics. We can forecast five years out, and mitigate way too much loan losses.

Over the years, credit unions merely got analytic equipment you to definitely believed risk within personal mortgage top. However, Wescom wished a solution who would prediction it is possible to loss and you will allow mitigation circumstances having a portfolio of fund. With SAS , Wescom possess a better knowledge of its loan-height risk well outside the personal loans.

Furthermore, the organization normally account for economic cycles which affect the financing union’s profile chance. Of the incorporating wider economic details, Wescom can capture the latest performance impact out of seasonal plus one-go out events. The financing risk class are able to calibrate the fresh dollars impact and you will measure it up against the chance cravings lay because of the panel.

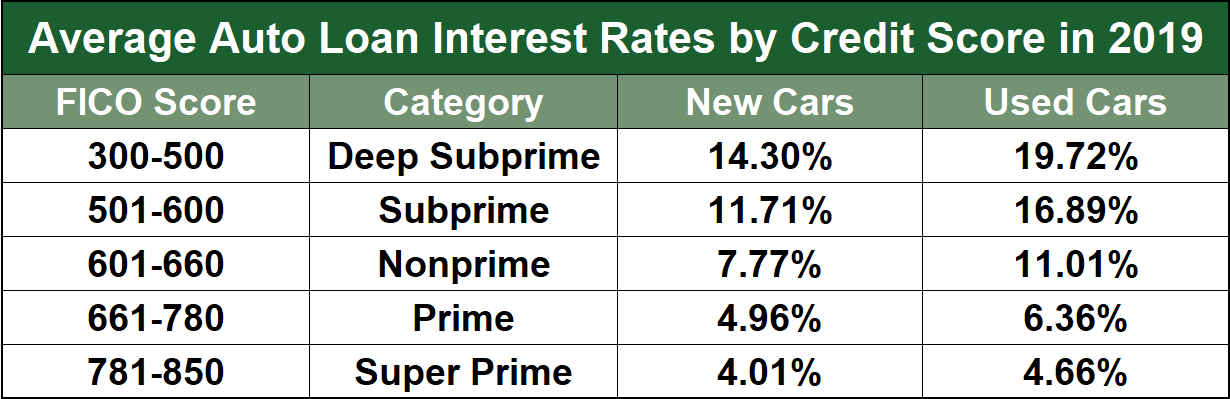

We would like to bring professionals having borrowing from the bank when you’re guaranteeing this new ongoing cover and you may soundness of one’s credit commitment, states Gumpert-Hersh. Today we’re able to measure exposure more effectively that have multiple scorecards due to good weighing’ verses a voting’ strategy. When a beneficial voting methodology from credit data is done, the variables manage are apt to have to-be satisfied, that may reduce profile into the fringe you to definitely work well. Yet not, an evaluating methodology (scorecard) delivers an individual mathematical worthy of, inside the score buy, having a blended make of several credit details because of the controlling, prioritizing and you will weighing for each and every because of the their personal and you can collective predictive prospective. This informative article helps us see mortgage abilities with an increase of reliability than simply a single characteristic otherwise score, particularly a good FICO or bankruptcy proceeding score, the guy explains.

Wescom status mortgage loss forecasts every month for an effective running sixty-day consider. The fresh forecasts is actually an excellent four-seasons forward evaluate abilities which have economic influences (econometric cycles) and you may top quality changes (borrowing time periods) more than so it timeframe. The credit risk department has actually designed, create and you may carried out a keen Allotment getting Financing and Lease Loss (ALLL) computation for the an ongoing foundation as well as intervals once the requested from the regulators. I play with as much as dos.5 billion ideas, states Gumpert-Hersh, and you will make 350 monetary spiders having 29 years’ value of study kept into the SAS servers, ready for usage.

On account of a simple-to-have fun with screen, Wescom composed initially predicts in two months as opposed to half a year since in the first place anticipated. That was the whole ramp-upwards, also it contributed to tremendous progress, says Gumpert-Hersh. SAS offered a full plan regarding project delivery that was told and supported by contacting. Profits on return are grand.

To stop losings, securing the company

Wescom have access to, extract and you will transmit analysis within the a secure and you can consistent mode away from numerous supply, together with six inner working expertise level 20 other products and exterior investigation source particularly Moody’s and you will Experian, also automated really worth designs out-of CoreLogic.

- Run pre-approved credit offer evaluating, that will online personal loans Pennsylvania can be found quarterly while the overall campaign debts has getting excessively best value.

- Size, maintain and you can overview of chance urges.

We can focus on about fifty percent higher reliability whenever deciding whether that loan have a tendency to perform’ or not manage,’ Gumpert-Hersh states. We could and additionally prevent bad selection, and is most harmful. Yields try markedly upwards. I’ve time and energy to really works a whole lot more strategically together with other executives during the the financing partnership into the risk and you will risk appetite pairing, he adds.

Good nuanced comprehension of borrowing exposure

The precision provides led to an appealing active. Because the delivering so it analytical means, the financing connection has increased new portion of auto fund offered having pre-approvals so you can 65 percent of all the automobile financing. At the same time, Wescom was able a reduced delinquency price, 0.24 per cent, throughout these exact same funds.

Using this type of active, managers requested perhaps the credit partnership can be more cocky in the providing pre-recognized financing in other issues while keeping in its exposure appetite. Gumpert-Hersh informed me how the show predicts, pre-approvals, risk appetite and you may paigns was basically incorporated into one strategy to disappear will set you back and you will accurately scale exposure.

By using analytics for the best individuals having pre-acceptance now offers, the credit relationship enhanced the paign acceptance price out of step three.4 per cent so you’re able to all the way to six % in one one-fourth. Such improvements try truly caused by a lot more focused sales considering predictive analytics. Viewing big research at some point pushes quantifiable low-chance finance at the a lower life expectancy deals costs.

Because of actual-day exposure specifications coordinated to the risk appetite, we have been able to use up-to-date criteria to your extension out of borrowing from the bank, better set credit lines and you can establish brand new selections actions in which called for, said Gumpert-Hersh. Owing to predicting, minimization and strategic planning allowed because of the SAS, Wescom protected huge amount of money and you may increased predicting accuracy. Above all, our panel is positive that the chance Wescom takes on is actually carefully measured and you can constantly within our preset chance appetite.