It is true one 2018 looks like a very good time so you can rating home financing. Pricing was dropping and home values try appreciating. Yet, if your score is simply too lower, you actually must look into continued to rent and increase the borrowing from the bank rating. Make all of your current personal debt money on time, and you may pay a credit fix providers to aid to help you boost your get. For the good year’s day, you’re ready to purchase your basic family. Talk to mortgage lenders on very first time home buyer software.

When your credit score is online personal loans IN just too lower for top cost, there is nothing incorrect that have taking a high interest rate. You may need to need a poor credit first time house financing and spend one to higher level getting a year or a few up until your own credit are increased. Next, once your get are higher, you could refinance and also a reduced interest rate. Of many mortgage positives anticipate the attention cost to remain quite low toward near future. Even though the Given provides raised rates 3 x on the past 1 . 5 years, very first time house customer home loan prices haven’t changed good contract.

Communicate with a lending company one to Focuses primarily on Very first time Household Customers

When you have a reduced score than just need, end up being in advance together with your financial about any of it. Some individuals has the lowest score because they had a bad borrowing experience during the last long time. Perchance you had a bankruptcy proceeding otherwise property foreclosure. The good news is you to negative knowledge cannot necessarily stop you against bringing a mortgage. You simply need to tell you the financial institution that you have an excellent adequate earnings to spend the expenses now. you will be show that you’ve been and come up with promptly personal debt money during the last one year so you can 2 yrs. Interest rates are lower. Home values try high. And you will credit is a lot loose than just it was five or seven years back. Even though you have a credit score as low as this new large 500’s, you continue to could possibly get property. Sure, you might have to shell out a higher rate or put alot more money down, however you still are often better off than just investing lease.

Today there are other mortgages readily available, and credit requirements was less restrictive. You need to focus on your finances along with your demands to choose which kind of mortgage is the better option for your. If you are considering loan with month-to-month mortgage insurance, make an effort to component that into the suggested homes expenditures to discover in the event the PMI was income tax-deductible with your own personal factors. For some Us citizens, the new 29 year fixed financing is one of popular, and you will FHA first time mortgage brokers enable it to be of many many a lot more Us citizens to be home owners. Prospective first-day homeowners have the option to try to get mortgage loans and you may domestic to find features either owing to on line platforms or even in physical cities. Home loan companies are furnished to offer basic-day client system approvals in this a matter of minutes, so seek information and start to become a citizen.

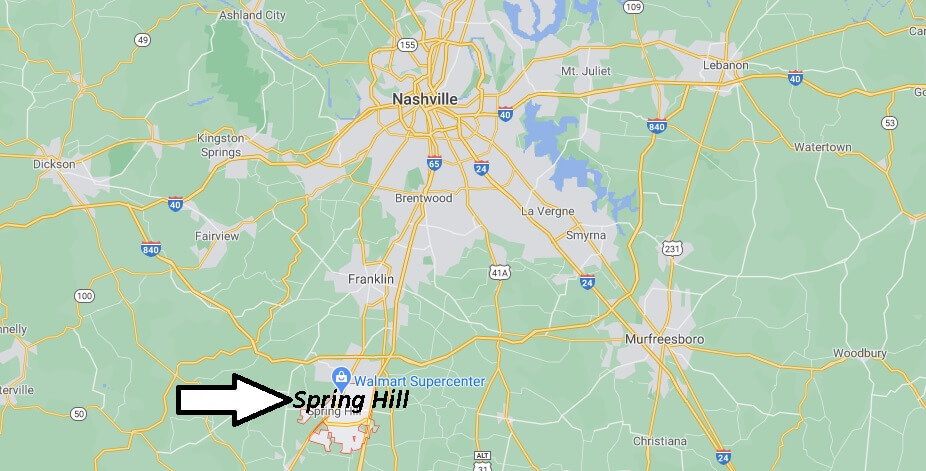

You can find maybe not a large amount of 100% financing finance kept towards You mortgage is actually supported by the new United states Company regarding Farming, and it has already been specifically readily available for low income minimizing borrowing borrowers that to purchase during the a rural area. You don’t need become to invest in a ranch possibly.

Good-neighbor Across the street The solutions having instructors and you will very first responders and a lot more

- Search communities. Use websites such as realtor and zillow locate a getting to own communities, cost of living and you can public transit. Plus head to discover properties to get an end up being on the land on your price range within the communities you want. Thinking about real property is inspire and motivate you to reduce debt and you can cut.