You’ll qualify for a mortgage whenever you create steady money, whether or not employed or thinking-operating. Since the a self-employed borrower, showing that you have a reputable source of fund will be by far the most crucial planning.

Lender comments and you may tax statements are some prominent an approach to prove the steady economic channels. It is necessary making sure that you can prove their income with good documentation.

Help make your money record offered

Very financial businesses would wish to see your money records for at the very least the past season. For that guidance, lenders might opinion your income tax go back.

Change your method to make certain you possess an income tax return one to reveals an effective net income, especially if you are located in this new habit of playing with a great deal regarding write-offs.

Bank statements was a different way to establish their financial provider. Loan providers usually require up to 24 months’ property value financial statements to help you determine their mediocre monthly earnings. This is certainly centered on deposits made into your finances.

Generate an enormous down-payment

Loan providers basically view you due to the fact a reduced amount of a threat for individuals who make a big advance payment as the in so doing, there are smaller obligations to repay. The monthly mortgage repayments could well be down, and you may reduce money lent for individuals who standard. With a down-payment of over 20% may also help you save of spending private home loan insurance.

Not only can a huge down-payment succeed easier for you to qualify for a mortgage, nevertheless also can make you the means to access top terminology particularly down rates.

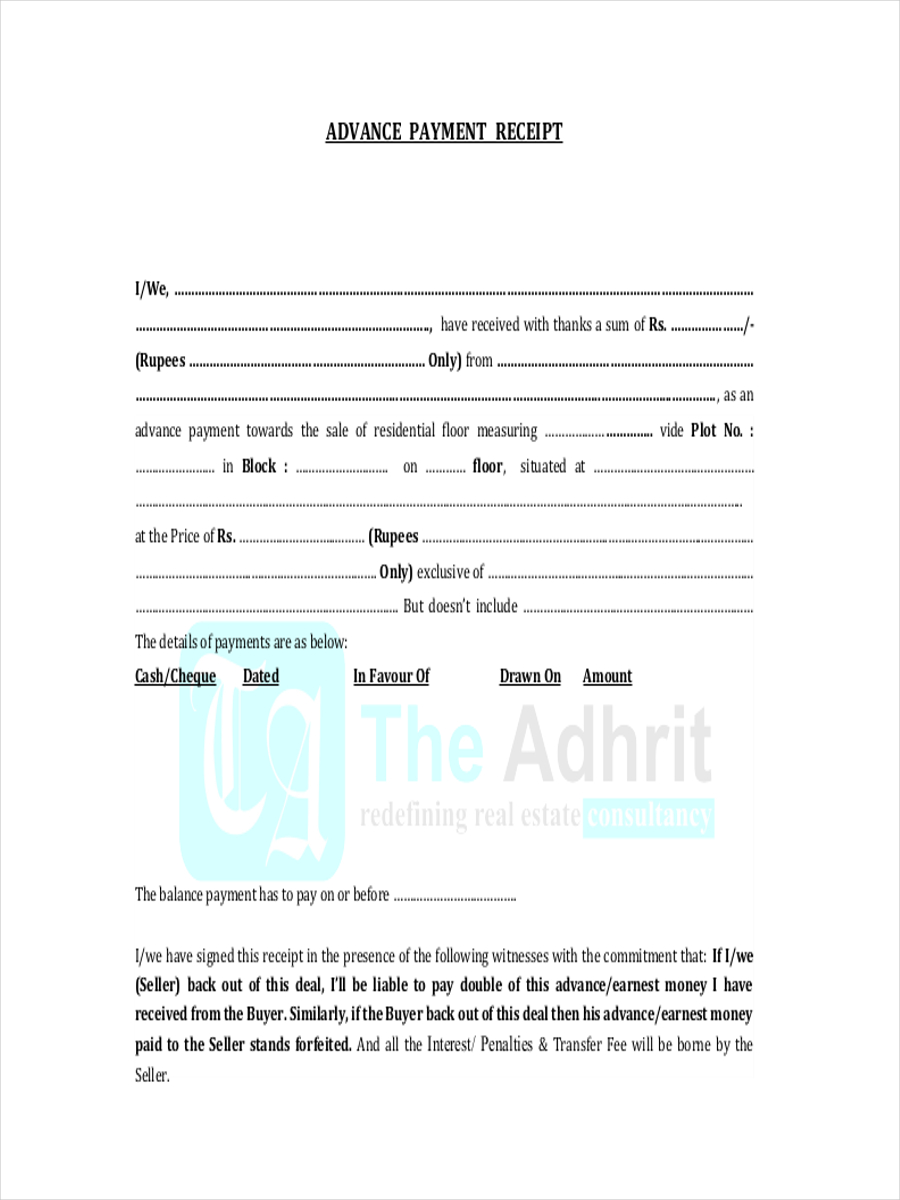

Prepare all economic data files

The loan elite group youre working with enables you to know and that monetary files you really need to render. Although it may vary, financial statements and you may tax statements is extremely asked. Verify that you have got those who work in convenient. If you don’t, have them as fast as possible.

Just like the notice-operating homebuyers generally have harder sourced elements of earnings, they should look greater. Hooking up their accountant with your bank is a sure way of accomplishing it or taking a whole lot more proof of earnings.

Try to save yourself

That isn’t a requirement but preserving huge makes it possible to once you make an application for a home loan online pay day loans Inglenook. In the event the very little else, it will offer a whole lot more alternatives including reducing the matter out of obligations you’re taking into by making a big down payment.

How can i tell you self-operating money having home financing?

To exhibit self-functioning money having a mortgage, you should provide a track record of uninterrupted thinking-a position money for at least two years. Really financial banking companies or enterprises can look for the next:

Employment verification

Employment verification will help you to prove that you are notice-employed. The easiest way to rating a career verification would be to show emails otherwise letters from all of these source:

- current subscribers

- signed up official individual accountant

- professional groups that guarantee your registration

- Doing business Since the (DBA)

- insurance coverage for your business

- any business or state licenses you hold

Money files

You may be a stride closer to providing acknowledged to own a good financial if you have income documents. Really lenders inquire about these records:

- individual taxation statements

- profit-and-loss comments

- lender comments

Would it be better to be employed otherwise mind-useful for a home loan?

From home financing lender’s perspective, it is better to determine debt reputation if you’re working rather than care about-operating. Is an easy report on functioning individuals and you can mind-operating consumers:

Working financial

An used borrower usually has a developed salary using their employer and is easily able to produce a position verification and you will earnings documentation. Lenders utilize this guidance to determine just how much money the borrower need to generate to repay the financial.