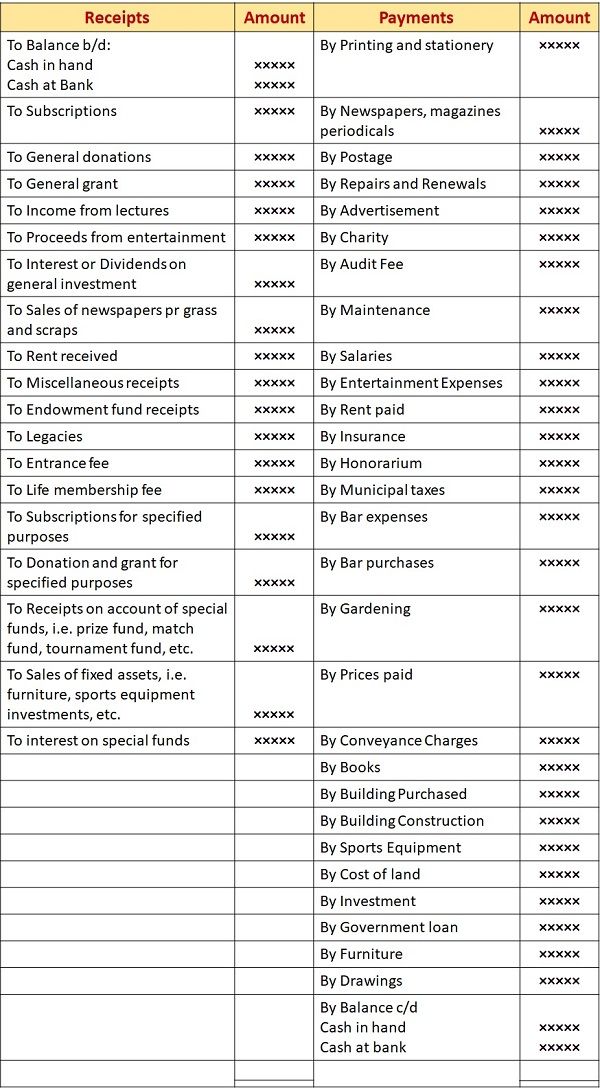

Just what You will understand

Financial rates transform constantly. In any event, it’s not necessary to proper care continuously. Today’s costs are below new annual average off 31-seasons repaired-rates mortgages A home loan having an installment name away from 29 ages and mortgage that’ll not change-over the new life of the loan. 30-season repaired-price mortgage loans Home financing with an installment label off 29 many years and you may mortgage loan that won’t change over the lifetime of the borrowed funds. for a lot of the fresh new seventies, eighties, and you may 1990s.

The 70s and mid-eighties

The latest Federal Home loan Home loan Agency, additionally known as Freddie Mac, first started tracking average yearly prices for mortgages starting in 1971. In the 1st long-time regarding tape, prices started off anywhere between eight% and 8%, but of the 1974, it mounted around nine.19%. We finished from the 10 years from the in the long run entering double digits with 1979’s annual average from eleven.2%.

Once we on course towards 80s, it is important to keep in mind that the nation was at the center of a depression, largely considering the oils crises away from 1973 and you will 1979. The second petroleum treat triggered skyrocketing rising prices. The expense of goods and services flower, very fittingly, mortgage pricing did too. So you can boost a good flailing savings, the fresh new Federal Set aside increased brief-name rates of interest. Thanks to their work, more individuals was indeed saving cash, but you to definitely implied it was and more expensive to find a domestic than at any point in current big date.

The newest annual rate achieved % when you look at the 1980, and in 1981, this new % rates are but still was Freddie Mac’s prominent submitted figure. Thankfully, we have essentially already been on the a reduced trend ever since this fateful 12 months. The remainder eighties have been a high walk down from the new decade’s peak. We round out the eighties just under the final filed speed of your seventies at a substantial %.

The newest 1990’s and 2000s

As compared to prices of earlier years, brand new 1990’s was basically all that and you can a candy bar! Rising prices eventually arrived at calm down, and besides 1990, not an individual seasons-stop percentage finished in double digits. And though the average rates getting 1999 settled on seven.44%, rates have been as little as six.94% the entire year early in the day-a low annual rates ever before submitted at that point of them all. Not too shabby americash loans Columbus!

Of a lot advantages chalk the new fall off from the early in the day ages to this new beginning of one’s sites years. Including an even more informed debtor society and area overall, the country’s money during the the brand new technologies contributed to the production of a great deal more services and you can sparked a recouping discount.

Once the new millennium folded as much as, discover an initial dive to eight.05%, but the remaining portion of the 2000s never watched a yearly mediocre of greater than eight%. But all was not because seemed, just like the subprime pricing helped bring into the 2008 Construction Crisis. To repair the brand new injured business, the Federal Put aside smaller interest levels in order to stimulate the newest economy and you will create borrowing from the bank reasonable again for the majority of People in america.

The fresh new 2010s

One thing don’t slow down on 2010s, aside from a couple small increases within the 2013 and you will 2014. Many trait this new plunge off step 3.66% inside 2012 to three.98% inside the 2013 towards Fed’s management of the connection is why crisis, the newest Fed announced it would cut down the huge bond-to acquire stimuli whilst sensed the country’s cost savings is actually healthy after once again, now five years taken out of this new freeze. Which large-size effort lead to a small upsurge in the average rate halfway from the .

2020-2021

In this two-seasons months, Freddie Mac computer submitted a reduced financial prices ever. As a result to your international pandemic, the Fed less the fresh new government loans rates so you can 0% – 0.25% to help you incentivize credit. Very, short-label and you will much time-identity cost diminished, and also the yearly averages into the couple of years hovered at around 3%.

2023-Expose

Around , rates began ascending once again. The 31-12 months fixed rates become a more sluggish trip towards 8%. However, because of the start of 2024, cost had get back as a result of as much as six.75%, according to renewed user believe and lower inflation.

What causes Pricing to switch?

Thus, in the event the home loan rates changes day long, what is the cause of the seemingly endless fluctuation? When you’re there are many different factors that can apply to costs, check out priples:

There is no-one to manage the items listed above, but you can reduce your financial obligation-to-money ratio (DTI) and you will enhance your credit rating in order to secure a better speed for you and your family.

Should you want to speak about more info on a brief history out of 31-season fixed-price mortgages, today’s criteria, or tomorrow’s mindset, don’t hesitate to extend!