You obtain the home equity mortgage since the an upfront lump sum and you can pay it back just as you pay an initial mortgage, thru repaired monthly installments which have appeal.

Family guarantee finance is actually most readily useful if you want lots of bucks immediately, including for a costly house repair. We fool around with domestic equity loans for possibilities which are often or even difficult to financing, given that first-mortgage is used because a loan for selecting one assets. Yet not, understand that the brand new rates out of domestic security fund are likely to be sometime higher than those of antique mortgages.

HELOCs

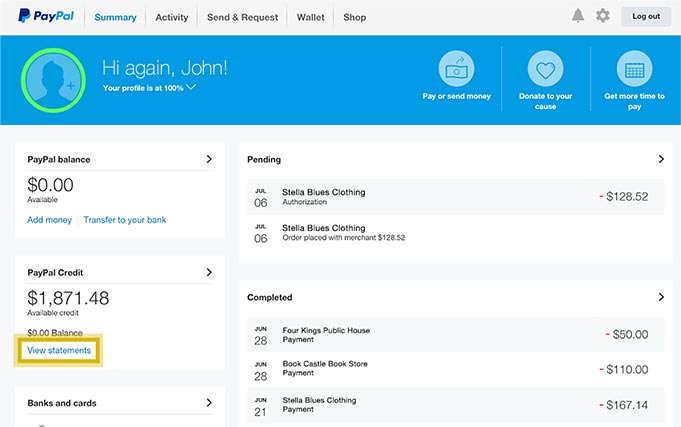

HELOCs really works a lot more like credit cards and gives much more independence for ongoing expenditures. After setting-up a home security personal line of credit otherwise HELOC, you could borrow cash out of your home guarantee as often as wished and also in people amount wished (up to a maximum set from the bank, always dependent on exactly how much you currently owe into house loan). There’s absolutely no lump sum provided. As an alternative, your borrow, repay, and you can pay appeal towards the only what you want at a time.

Including, say you’ve got an effective HELOC that have an optimum credit limit out-of $9,000. If you utilize $5,000 of these restriction toward domestic renovations, you’ll have $4,000 kept that you may obtain. But as soon as you pay the total amount your debt, you’ve got use of the full $nine,000 once again.

You can make use of the HELOC within the draw period an established period your credit line was energetic. You have to make minimum monthly installments on the people numbers your use just like a charge card.

At the end of this new mark period, the fresh new payment period begins. For the installment period, you could no further sign up for currency and ought to pay-off the complete harmony kept on HELOC, and additionally any accumulated attract. The duration of the fresh new installment several months can vary, but it’s tend to as much as two decades .

HELOCs was an amazing choice if not know the way far currency you will need or if you want money spread out over a longer period.

It is vital to remember that both nd financial costs having HELOCs was variable, which means that they may be able increase and you may slip with respect to the financial list your lender is utilizing. Interest rates of these are typically sometime higher than very first financial rates. Although not, HELOCS create are apt to have Hudson installment loan with savings account highest borrowing from the bank limits than just handmade cards or signature loans. You can also manage to secure a fixed interest. Nevertheless they are apt to have low or no financing origination charge, a unique advantage of these loan.

Knowing the distinctions ranging from those two kind of 2nd mortgages can also be make it easier to purchase the the one that aligns greatest along with your financial specifications and you may needs. Imagine products like your borrowing from the bank needs, installment choice, and you may financial strategy when deciding ranging from domestic security funds and HELOCs.

Qualifying getting a second Financial

To qualify for the second home loan, you will need to meet certain financial criteria and show enough domestic collateral. Lenders generally come across the next:

- No less than 15-20% out of collateral in your home

- Lowest credit history from 620

- Debt-to-money ratio less than 43%.

These represent the standard conditions, but you’ll have to consult your lender understand the brand new certain criteria of your own mortgage and ensure your meet every required official certification before you apply.

Pros and cons off 2nd Mortgages

Next mortgage loans are a great way to put your guarantee to be effective and you will money a venture you could potentially if not end up being not able to cover the. However, they do has their cons. I discuss one another less than.