The new kiwi imagine moving on within the property steps stays really within reach for those those with were able to haul by themselves upwards on the ladder’s tough basic rung.

is the reason Financial Cost Report is well known to possess tracking just how affordable (or not) the new dream of owning a home is for very first homebuyers during the nation.

and music how good place earliest home buyers whom ordered the earliest house 10 years in the past is to try to grab the next step and get a far more costly home today.

The outcomes highly recommend brand new housing market has been most type so you’re able to people very first homebuyers, even after the problems with plagued the marketplace in the second half of your own history several years.

The individuals earliest home buyers must have accumulated a lot away from collateral within earliest house, sufficient to own a substantial put to their 2nd home. And mortgage payments thereon is consume below a quarter of their most recent once-income tax pay, given he could be getting about average wages.

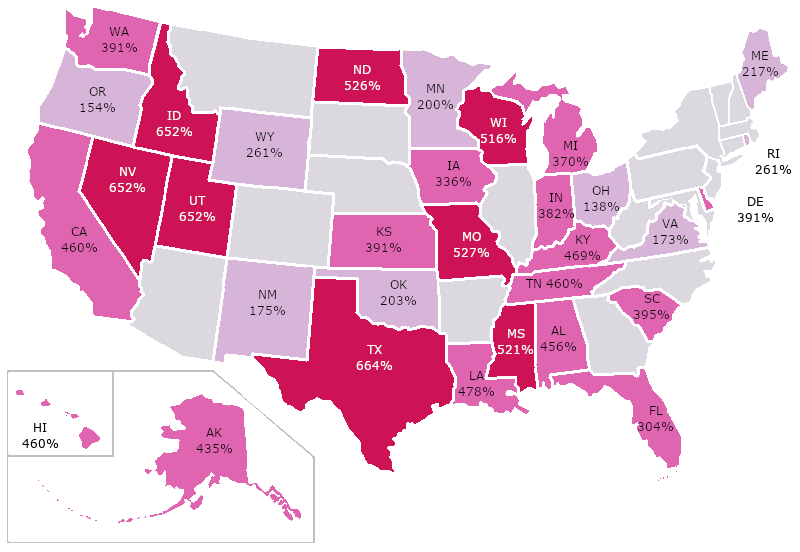

The 2 sets of dining tables below inform you a portion of the local and district cost methods having very first homebuyers regarding a decade ago trying to jump-up in their 2nd family, dependent on if they to start with bought you to definitely basic house with a great 10% otherwise 20% put

For example venturing out of these first domestic and you may beforehand and up to their next domestic are going to be better in their reach.

At that time, the typical of one’s both seasons repaired prices recharged by the major finance companies are six.13%, and if the home was actually purchased that have an effective ten% put, this new each week mortgage repayments might have been $399 each week.

Very a decade back, owning a home is actually a pretty sensible offer, for even somebody an average of earnings, regardless of if things were just starting to rating Ontario savings and installment loan strict having first home buyers looking to buy from inside the Auckland which have the lowest put.

Whether your house was resold at that speed, it can get off their first property owners having web guarantee from around $369,942, when they had paid down new an excellent financial and paid off company payment with the revenue.

Once they place all that equity into the acquisition of a unique home from the federal average price of $781,000, it can indicate they’d be purchasing it with a money put out-of 47%. So zero reasonable guarantee costs in their mind.

The mortgage repayments thereon could be $562 per week, and since the previous earliest home buyers are now actually 10 years more mature and you can develop smarter, they’d in addition to likely be most readily useful repaid.

This means the mortgage payments to their new home would use simply 24% of their take home shell out, if they was basically getting the latest average pricing from purchase 35-39 12 months-olds, it is therefore an incredibly affordable offer.

They show that the only set that regular basic homebuyers would not be able to move up the home hierarchy immediately after ten years are Queenstown, hence says the newest name having the nation’s very unaffordable property.

Who does provides used upwards about twenty-seven% of the very first property couples’ collect pay, whenever they certainly were making the latest median rate off buy partners old twenty five-31

Once they performed, they’d reduce guarantee to get to the in initial deposit to the its 2nd home as well as the mortgage payments inside it would be higher.

But not, once the basic homebuyers today can be up against good be unable to go into a property of their own, those who got new diving ten years ago will be today be seated fairly.