Addition

Restoration financing is actually specialised financial products built to let people from inside the resource their house improvement tactics. These types of finance are especially tailored to pay for costs associated with remodeling, renovations, or upgrading an existing property. Regardless if you are think a major house renovation or making smaller advancements, focusing on how recovery Shorter loans funds efforts are imperative to guarantee a softer and you may effective opportunity.

Just how do Renovation Loans Performs?

Renovation fund is financial products designed to provide investment getting family update ideas. They create home owners so you’re able to borrow funds especially for home improvements, enhancements, or fixes. Such financing will vary from traditional mortgage loans, as they are customized to afford costs out of remodeling or enhancing a current property. If you are considering a remodelling financing, its important to know how it works as well as the benefits they give.

To acquire a restoration mortgage, it is possible to typically need to go owing to a financial institution such as for example a financial or credit union. The program procedure comes to getting detailed information in regards to the recovery endeavor, like the estimated can cost you and you will timeline. The lending company commonly determine the eligibility based on circumstances such as for instance your credit rating, earnings, additionally the appraised value of your house.

After approved, the financial institution have a tendency to disburse the mortgage amount in both a lump contribution or in multiple installments, according to certain financing terminology. You should use these types of fund to invest builders, pick product, and you may shelter other restoration expenses. It is important to keep in mind that money of a restoration financing are typically kept in an escrow account and you will put-out inside the degree as enterprise moves on. It ensures that the bucks is employed for the suggested goal hence the brand new home improvements see specific requirements.

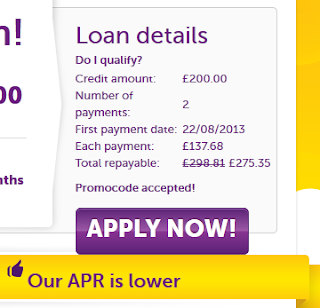

Cost terms and conditions having recovery financing will vary according to bank and the borrowed funds types of. Certain financing possess fixed rates of interest and need monthly premiums more a specified name, while some can offer versatile payment options. Its important to carefully feedback the mortgage small print, together with rates of interest, costs, and you will payment dates, in advance of acknowledging a repair financing.

When Should you decide Imagine a remodelling Mortgage?

Renovation funds are going to be a good choice for residents in different issues. Check out scenarios where to thought trying to get a renovation financing:

step one. Major House Home improvements: If you are intending extreme renovations including adding a supplementary rooms, restorations the kitchen, or updating the restroom, a restoration loan provide the necessary finance.

2. Place Improvements otherwise Expansions: If you would like a lot more living area, a renovation loan can help you money area enhancements or expansions, allowing you to do far more practical and you may spacious section in your family.

3. Expected Solutions: Whether your possessions needs important repairs, such as for instance fixing a leaking roof, replacement wrong plumbing work, or handling architectural issues, a renovation mortgage will help protection these types of will set you back.

4. Energy savings Developments: Restoration finance are often used to funds energy-effective improvements, such as installing solar panel systems, upgrading insulation, otherwise replacement old windows and doors. This type of improvements might help reduce your times costs while increasing the new value of your home.

5. Cosmetics Enhancements: If you would like refresh the look of your home with makeup advancements instance this new floor, paint, or surroundings, a repair mortgage can provide the money you want.

Restoration loans bring several advantages over other designs from funding, such as for example credit cards or signature loans. Basic, the eye cost having restoration funds are typically less than those people to possess handmade cards, making them a more rates-effective choice. Second, the borrowed funds wide variety available for renovations are often greater than what you could obtain which have signature loans. Finally, renovation money normally have way more versatile cost conditions, letting you favor a cost plan that suits debt disease.