Because of this you can nonetheless borrow cash purchasing a great domestic, despite less than perfect credit. not, the government set brand new qualified mortgage code (QM Code) that grabbed effect in 2014 to protect individuals off high-risk monetary activities.

Regardless of, there are lenders that provide low-QM financing in order to borrowers that have credit ratings that are while the lower while the five-hundred. However you will be in to have a lot higher interest rates as the bodies businesses particularly FHA or Va do not right back him or her.

Furthermore wise only when you cannot meet up with the being qualified financial conditions however, secure a consistent income and will create on-go out home loan repayments. Otherwise, you happen to be highly at risk of defaulting in your financial.

- You happen to be good retiree

- You happen to be operator

- You might be self-operating

- You’ve got a leading DTI

- You get your cost of living out of your investment

- You have high assets but low income

What other products affect mortgage pricing?

Aside from your credit rating additionally the down-payment, mortgage brokers also consider additional factors to select the rates towards lenders.

- Debt-to-money (DTI) proportion It applies to how much personal debt you already have in line with your revenue. Its a sign of what you can do to blow their month-to-month home loan. Extremely loan providers choose an excellent DTI away from thirty-six% otherwise lower.

- Cashflow Loan providers plus check out the employment history, that can mean how stable your earnings was. They look at the taxation statements, W-dos variations, and you may checking account.

- Loan-to-value (LTV) ratio This refers to what kind of cash you will have to pay-off compared to value of the property. If you have a larger down-payment, you might decrease your LTV, causing you to a faster high-risk borrower.

As you can nevertheless be recognized to own home https://paydayloansalaska.net/diomede/ financing actually that have a 400 credit score, it’s a good idea adjust their credit ranking basic.

Performing this will make it easier for you to track down good mortgage lender having a less expensive rate of interest. That help save you time and shed difficult brings on your credit history, that would as well as pull down your get.

So, how can you obtain way more affairs and increase your odds of delivering a much better mortgage? Here are some tips:

step one. Reduce your borrowing utilization

The borrowing usage impacts doing 31% of the credit rating. To boost your credit rating, you must maintain your borrowing from the bank utilization at the 31% of your own borrowing limit.

dos. Shell out their expense timely

You must spend the costs punctually as payment background profile getting thirty five% of credit score. One skipped payments past thirty day period could make you lose as the very much like 110 situations and will stay on your listing to own seven age.

Bonus tip: If you find yourself investing debts, such as for example resources, lease, and mobile contours, that are not said with the credit agencies, you can demand the organization so you can declaration your payments. Alternatively, you can look to own businesses that report to expense money within the the initial put.

step 3. Remark the credit file and dispute mistakes

It is beneficial to succeed a habit to examine your credit profile. You happen to be eligible to one to 100 % free credit file on a yearly basis regarding the around three federal credit reporting agencies: Experian, Equifax, and you can TransUnion.

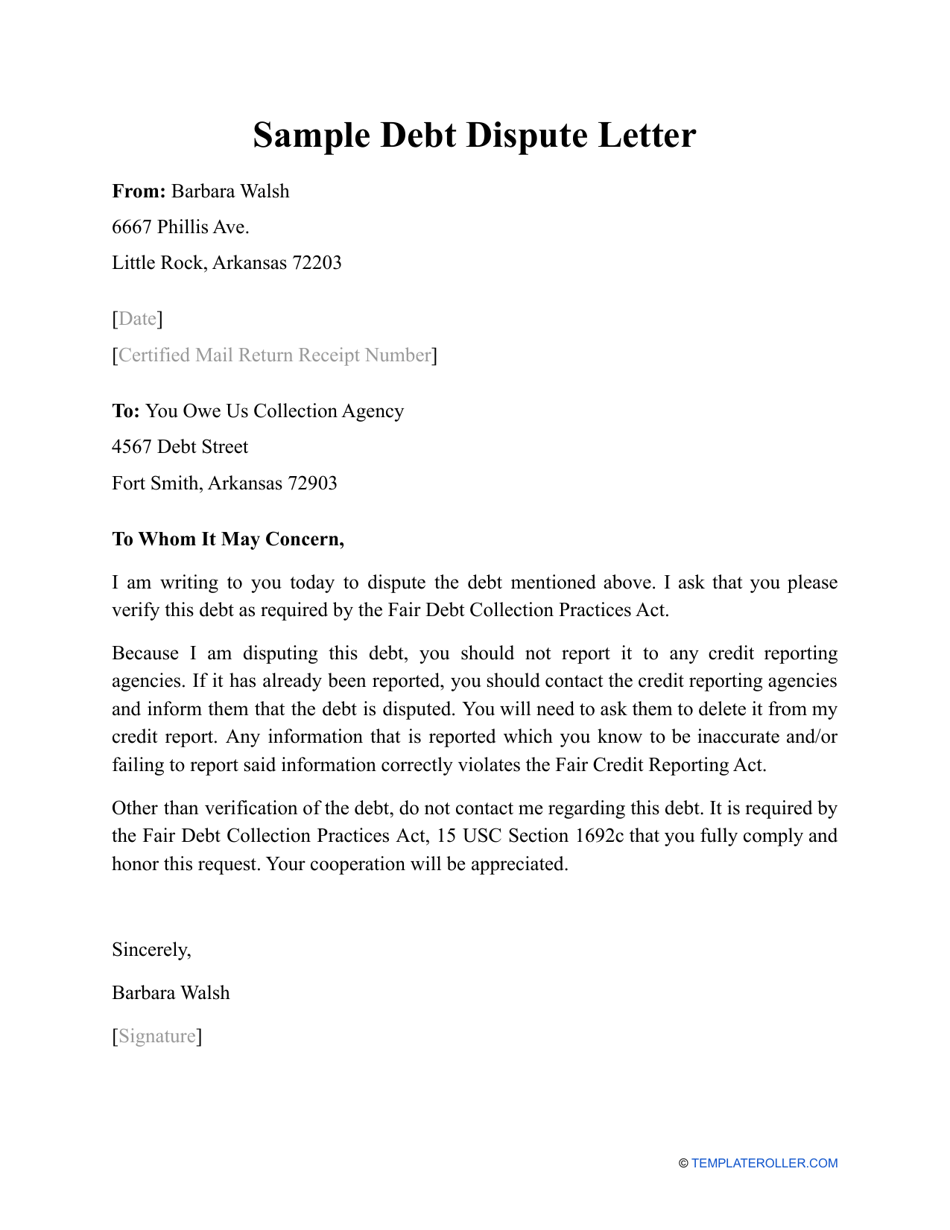

If you find one discrepancies that remove your own rating down, posting a dispute page toward credit agencies and also the collector. You should render supporting records to show their says.

cuatro. Continue old personal lines of credit unlock

You would imagine it’s a good idea to close off old lines of credit you to so long as use, for example credit cards with a high attract. But not, the age of your credit report is the reason doing fifteen% of one’s complete get.