If you’d like currency to own a giant purchase otherwise disaster you would like, it’s also possible to consider borrowing from your thrift deals package. Find out how to obtain from a great thrift discounts plan.

Government employees and you will people in the uniformed characteristics is generally eligible to borrow off their Thrift Deals Plan. A teaspoon financing allows members to help you use off their old-age membership to invest in a large expense otherwise shelter disaster costs. Tsp funds is enticing because you are credit of your self and you may he has got a low interest rate.

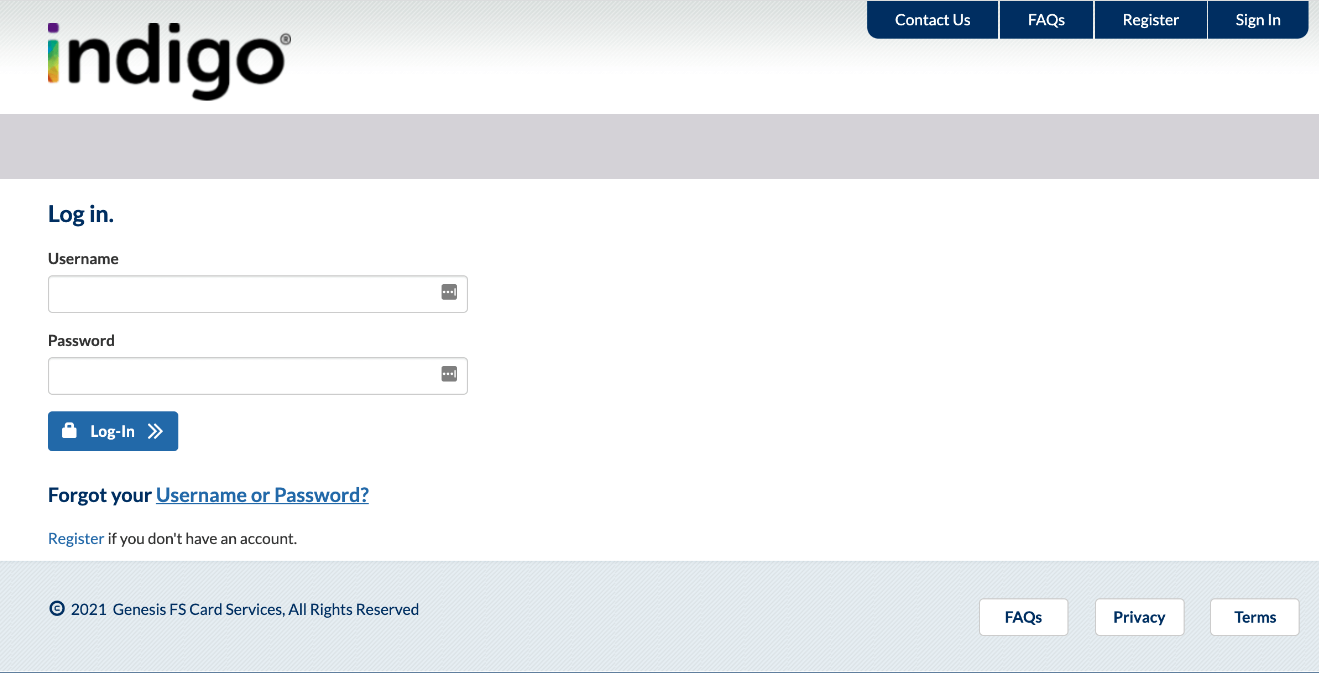

You might acquire a teaspoon financing by filing an online app function on the Teaspoon website. Start with log in on My personal Account in the with your username and password, and employ the web based equipment to complete the mandatory recommendations, such as the matter you want to obtain, the purpose of the borrowed funds, the fresh new institution you work for, whether you are hitched, an such like. You’ll be able to be required to offer certain papers when filing the actual software.

What is actually a tsp financing?

A tsp financing are a plan mortgage enabling qualified players to tap their old age offers and you can afford the money including focus back into the account. Teaspoon money are similar to 401(k) financing due to the fact one another arrangements ensure it is members to acquire using their old-age offers, but Tsp funds are designed for government pros and you will people in the fresh uniformed attributes.

You can bring sometimes a tsp financial or a teaspoon general-goal financing. If you acquire a teaspoon home loan, you are able to the mortgage proceeds to find otherwise create your principal quarters, and is a property, condominium, cellular house, or Rv house, if you will use the home since your number 1 house. Instead of a traditional home loan, a tsp home loan cannot make use of domestic as equity to your loan. Teaspoon mortgage brokers have a cost ages of doing 15 ages.

By firmly taking a broad-mission Teaspoon financing, you should use the mortgage proceeds just for things- spending medical expenditures, degree, vacation, rooftop resolve, purchasing an automobile, etc. General purpose Tsp loans possess smaller installment periods than simply Teaspoon household money, and you’ll be expected to repay the loan in one single so you’re able to five years.

Exactly how much can you obtain regarding an excellent thrift coupons plan?

The minimum Teaspoon mortgage you could potentially borrow is actually $1,000. However, Teaspoon preparations features certain legislation to select the loan amount a great participant normally use using their retirement membership.

You can’t use more fifty% of your own vested account balance, otherwise $ten,000, any is actually greater, less people a good loan balance.

How to get loan places Hidden Valley Lake a tsp mortgage

Early your own Teaspoon application for the loan, you should always meet the minimal criteria to possess Tsp loans. Typically, you must have at least good $step 1,000 balance throughout the Tsp account, feel a recent federal employee, and stay during the “effective shell out” updates.

For many who meet with the Tsp financing conditions, you might initiate the fresh new Tsp financing procedure by log in in order to My Membership within . New Tsp webpages has a tool you to definitely walks your action-by-step through the software techniques, and you should complete the mandatory fields and supply one expected files. You can upload the fresh new papers into the Tsp site or mail they to Tsp.

If you find yourself a national Group Old age Solution (FERS) fellow member and you’re married, your wife need certainly to signal the borrowed funds contract so you’re able to say yes to brand new loan. Plus, if you’re applying for a tsp mortgage, you might be necessary to offer paperwork to exhibit evidence of our house youre buying and/or home we need to pick.

You could finish the Tsp loan application online. However, in some cases, you might be necessary to printing the program and you can posting they to Teaspoon through post or fax. To own on the web software, you can get approved and you will found an excellent disbursement from inside the two weeks. Sent apps can take days to acquire acknowledged and work out an excellent disbursement.

Just how to pay the Tsp financing

You need to start making Teaspoon financing repayments inside 60 days once finding the newest disbursement. Constantly, when Tsp process the loan, it ought to notify the agency’s payroll work environment therefore it can be start making payroll write-offs from your income. The loan money go back to their Tsp account, and are also invested considering your investment election.

If you have split of provider and you’ve got a fantastic Teaspoon financing balance, you will still be asked to build mortgage costs. You might plan to repay brand new an excellent loan in one single lump sum payment or keep to make mortgage costs by view, currency acquisition, or head debit according to research by the exact same loan payment terms while the in advance of breakup. However, if you fail to spend the money for loan money, you might allow the loan are foreclosed, and you can any delinquent loan equilibrium might possibly be handled since taxable income.

Should you decide need a tsp mortgage?

If you need to borrow funds to own a crisis or highest pick, a tsp mortgage may be a good idea because it is a low-focus particular borrowing money compared to other large-attention financing selection for example unsecured loans and you may bank card debts. You might bring a teaspoon mortgage to meet emergency expenses, buy property, pay medical expenses, and other large costs.

But not, there are some constraints that have Tsp money. First, when you borrow money from your Teaspoon membership, you will miss out on the profits you’d enjoys raked within the had the money stayed on the membership. Even though you might be paying rates of interest in order to yourself, the eye earnings are usually below what you could has actually generated. And, the interest money commonly income tax-allowable, and you also won’t make the most of a destination deduction whenever filing income fees.