Don’t let yourself be conned by the name of that 2nd one. You may be eligible if you are to acquire a home in just regarding any rural town and some suburbs. Since the a bonus, it’s not necessary to be concerned from inside the agriculture at all to help you be considered.

You have got observed the term “mainside” when you look at the “one or two main types of home loan without advance payment.” That is because there are more, less of these. Like, Ds bring instance income so you’re able to medical professionals and you will doctors, and lots of anyone else do to almost every other health care professionals. Meanwhile, local programs may provide assist to many other categories of key professionals, such as for example earliest responders or coaches.

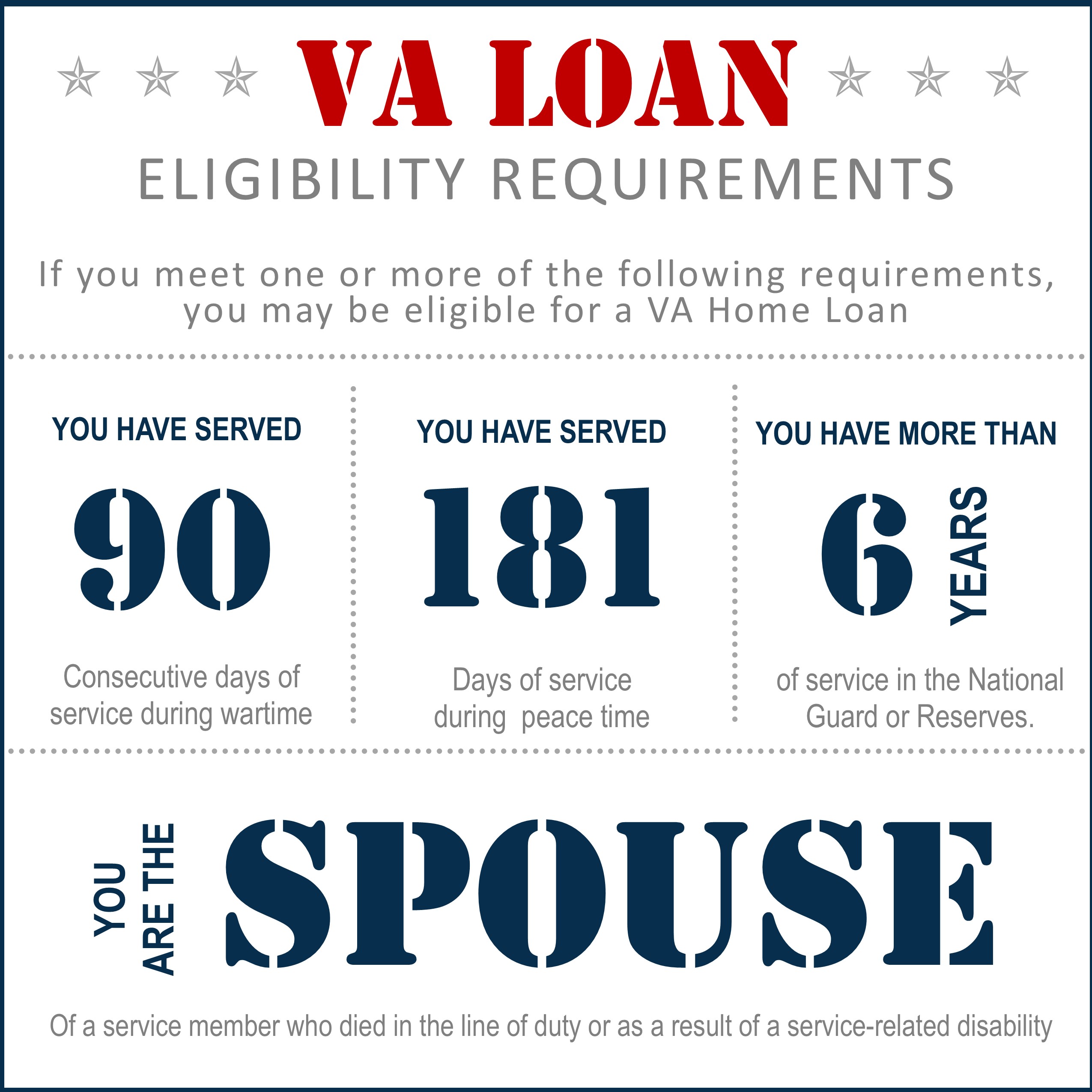

Virtual assistant finance

Virtual assistant loans are among the most famous brand of no-down-percentage mortgage. Just like the identity implies, they have been available merely to experts and you can current servicemembers. Whenever you are that, and you may haven’t been dishonorably discharged, there clearly was a top possibility your qualify. Yet not, you will find some Virtual assistant eligibility laws, mostly regarding the time and time of your service.

With your money, you have to pay a-one-big date financial support commission initial. That’s currently 2.3% of your own mortgage worth to possess first-time buyers making no down payment, although it you’ll change in the long term. The good news is contain one to on loan in place of coming up with the bucks.

Va mortgage benefits and drawbacks

Yet not, you’ll find restrictions on this, together with one settlement costs we need to roll up to your mortgage. This is because you can’t use over 100% of appraised market price of the property. So you could must find an empowered vendor otherwise a great offer where you can find manage to have enough room to obtain all your valuable will set you back on mortgage. It is a myth that people that have Va finance normally force a great merchant to pay for closing or any other costs.

You to capital fee is an aches. However it is together with a blessing. Because changes new month-to-month mortgage insurance rates most people spend, if they can’t improve good 20% down-payment. Over the years, it could help save you big money.

New Virtual assistant cannot place one lowest thresholds for credit ratings. But, since the explained significantly more than, personal loan providers may — and more than perform.

USDA loans

You are forgiven to have while USDA loans try categorized Best Miracle. Not enough folks have also heard of all of them. Unnecessary with observed them guess they’ve been just for men and women involved with agriculture or perhaps who would like to alive during the a rural backwater. But neither of those is true.

Indeed, of many guess one 97% of your landmass of your own All of us drops during the area eligible for good USDA mortgage. New USDA website provides a look device that enables you to browse to have personal details one to qualify. And it comes with lots of suburbs. At the same time, there is absolutely no needs knowing one to end off an effective tractor — otherwise out-of a great hoe — on most other.

USDA funds: Eligibility and you may conditions

You will find, but not, some personal qualifications obstacles that could journey upwards of a lot. This type of money are made to have reasonable- and you may low-money group and people. While can not earn much more than 115% of the average income towards you. How much cash would be the fact? Again, the USDA webpages enables you to check money restrictions county by state. More people in your family, the greater number of you can make and still meet the requirements.

When you get one of those, you are going to need to shell out a fee of 1% of the loan amount in your settlement costs. This payment will be put in their mortgage balance, if you do not obtain altogether over 100% of house’s appraised market value.