Trick Takeaways

- Signature loans try unsecured loans, and you will loan providers think CIBIL or credit score in advance of granting recognition.

- Credit scores echo of your credit history, along with previous payment, total obligations, an such like.

- The fresh new score is actually a mathematical contour between 3 hundred-900.

- It is easy to get Personal loans getting CIBIL score out-of 650 and you will significantly more than.

- You can alter your credit history of the borrowing and you can paying fund responsibly.

Organising loans in order to meet various costs that appear when you look at the lives can bad credit personal loans Phoenix be tricky. Yet not, you can rely on financial assistance offered by finance companies to aid you monetarily. A consumer loan helps you see all the you desire, should it be funding a life threatening enjoy, or addressing a crisis. not, while making an application for a personal loan, the CIBIL Rating is extremely important. Keep reading to understand getting a personal loan to have CIBIL get out of 650 and over.

What is CIBIL Get?

Your credit score or CIBIL (Borrowing from the bank Guidance Bureau Limited) rating was an effective 3-little finger numerical profile, starting ranging from 3 hundred and 900 activities. They reflects your credit report, that is compilations of information that will help loan providers ascertain their creditworthiness. Your credit score is determined considering your borrowing from the bank credit and payment records, on top of other things.

How does CIBIL Score Connect with Personal bank loan Programs?

When you get a personal loan, lenders request your credit report, also called new CIBIL statement. Just like the Unsecured loans is actually security-100 % free unsecured loans, lenders you desire warranty you have the ability to pay back the fresh new amount borrowed in a timely fashion. They are able to get this to warranty by the assessing your earlier in the day borrowing cost actions.

Most loan providers within the India consider a CIBIL rating of 600+ a good score to check your own creditworthiness. As a result, getting a personal loan to own CIBIL score away from 650 and you can more than can make availing out-of fund extremely effortless.

How exactly to Boost CIBIL Get?

Unless you have the needed CIBIL get, you can get an unsecured loan to own CIBIL score from 650 and you can significantly more than by-doing the next something.

- You should never obtain any more finance until you repay your own dated costs.

- Pay off one a fantastic stability on the financial handmade cards within the initial, unlike make payment on minimal number due into the credit card debt.

- Pay all EMI money on the some fund promptly. Late payments suggest irresponsible percentage record, and that, consequently, impacts your credit rating.

- Dont cancel credit cards because you might need these to perform credit score later on. But not, dont coast as well close to the credit limit because you are going to feeling your CIBIL borrowing.

- Stop utilising more 31% of one’s provided restrict on your own credit cards.

Getting Unsecured loans that have Lowest CIBIL Ratings

Despite having lacking a good credit score away from 600+, you might get that loan. Specific finance companies and you can creditors would render Signature loans so you can individuals that have a lower life expectancy credit history. To compensate to suit your credit score, they may cost you a higher level interesting or inquire that give guarantee. Merely always meet up with the minimal CIBIL rating to have a great Consumer loan put because of the loan providers before handling him or her.

Final Note

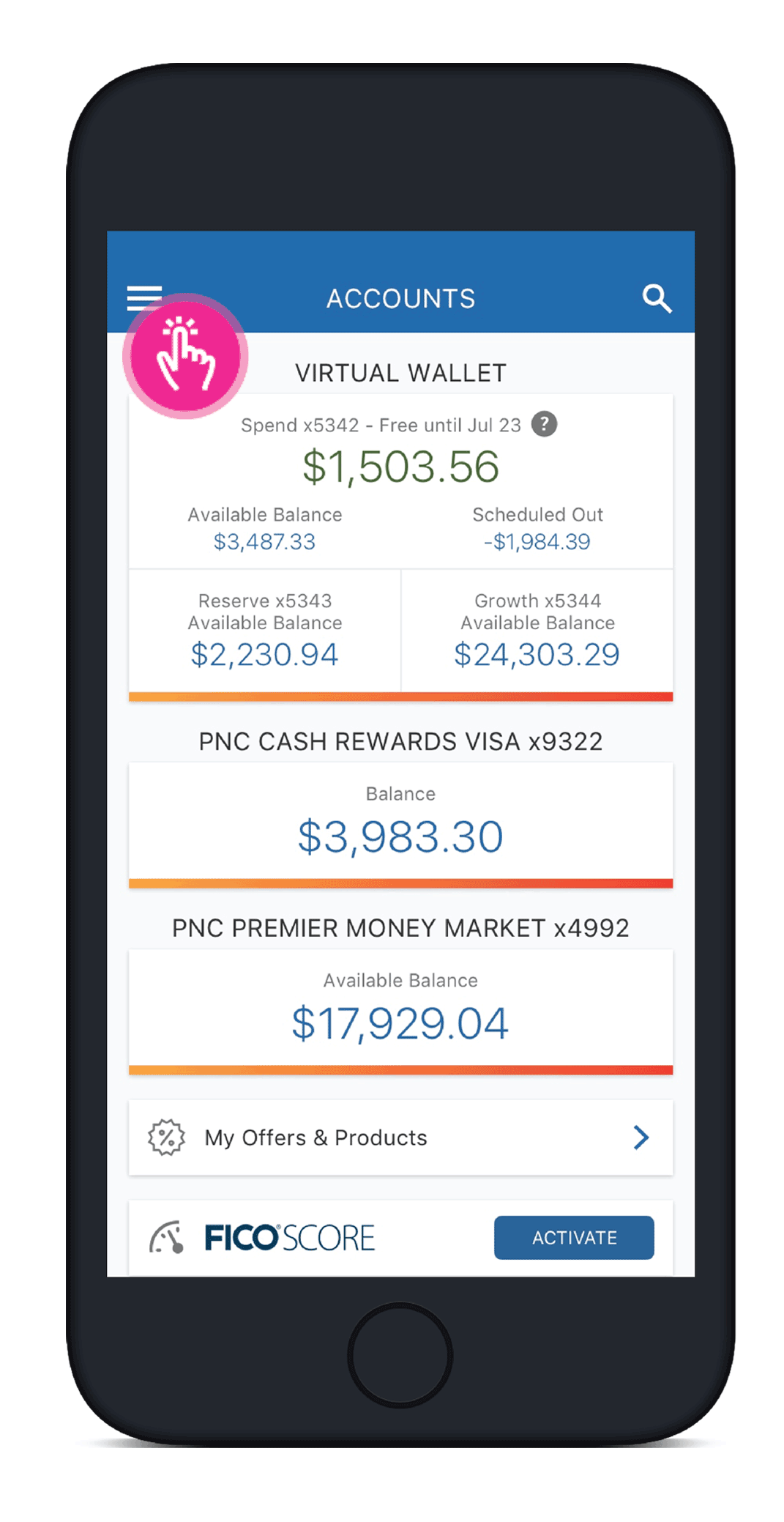

digibank now offers Consumer loan getting CIBIL score off 650 and over. You might get such loans which have maximum simplicity. Score higher-worthy of mortgage quantity at the glamorous interest levels with effortless repayment possibilities.

Install the digibank cellular application on the smartphone. Discharge the application and click on “Get Unsecured loan” hook up into the log in web page. Together with, you could discover checking account on the internet with our company.

*Disclaimer: This information is to possess guidance purposes merely. We recommend you have made in contact with your income taxation coach otherwise Ca getting professional advice.