It approve page will state brand new paid matter, cost day, financing tenure, and you will interest rate, in addition to validity of one’s allocation page.

Just after receiving the fresh approve letter, you’ll have to create the deposit bill to the bank manager loans for bad credit Holtville AL open today. A different sort of name because of it acknowledgment is own sum receipt’. Shortly after searching the fresh new deposit bill lender/lender usually next tell you about brand new go out of your own first installment. Till the latest disbursement procedure, you’re going to have to create the documents. To mention data files such as for example allotment/sanction page, agreement copy, burden certificate, and credit facility acknowledgment. And adopting the documents was canned, financial will likely then legally and you will commercially evaluate the value of.

After the completion of all of the formalities and as for each and every the fresh fine print of one’s sanction page, the bank will likely then processes the home mortgage disbursement matter. The sanction letter doesn’t necessarily join the bank on interest speed stated from the approve letter. Be aware that the very last interest to suit your mortgage can get change from the main one about initial sanction page. The lending company will establish the real price in accordance with the disbursement day and you will question a modified sanction page.

The lending company often sometimes disburse a complete number at the one go or even in installments according to the energy of your own borrowing from the bank get and progression of the house. If your build is done financial usually disburse a complete family amount borrowed. On occasion, individuals with an excellent dated track record and you may compliment credit history can even be eligible for good pre-approved mortgage.

Eligibility Standards

Since you have ultimately decided to submit an application for a home loan first of all We qualified to receive? Till the financial processes, it is essential to determine your full qualifications, considering which the financial/financial often disburse a specific amount. Their qualification depends upon some factors such as your credit history, throw away surplus earnings, your revenue versus expenses, family or wife or husband’s money, disregard the really worth for example shares and you can holds, total assets, income stability vs liabilities, and therefore highlights you happen to be paying capacity.

Besides your revenue bank will also consider your decades ahead of granting. The entire reason for the bank is always to ensure that you’ve got the capability to repay the loan. Financial usually makes up 50% of your own disposable income as the a cost share, and this the greater the money, the better the loan amount. Aside from your earnings studies, your house financing period and interest rate can also be factored from inside the up until the bank ount.

Maximum Disbursement Allege

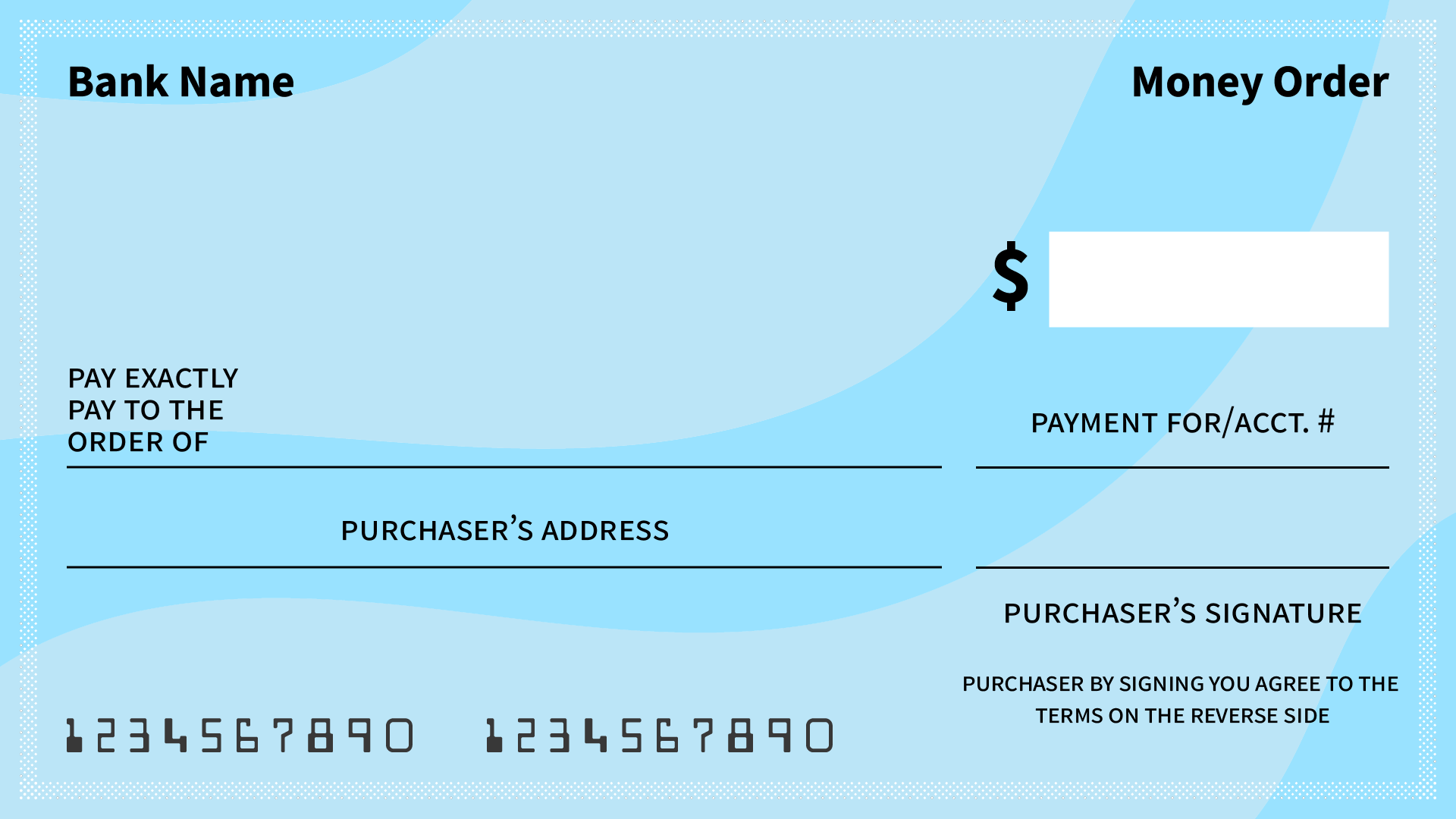

Before you apply for a home loan, it is very important figure out how far advance payment you can also be spend from your own pocket, and that is referred to as very own sum count.’ According to the advance payment skill you can assess the new home loan disbursement count you need to allege.

Really homeowners create 10% 30% down payment depending upon its capacity, the rest they provide on the lender. Even if you qualify for a high amount borrowed it is best if you create a max down payment and take good at least the loan matter as it runs into significant interest on the the outbound EMIs.

Banks/loan providers will usually expect the consumer and also make a minimum of 10% 20% deposit of total worth of. While banking companies often disburse all of those other number that actually is applicable taxation such as an excellent stamp-responsibility, membership fees, transfer charges, and in some cases also possessions taxation.

Lender can also costs an excellent 0.5% -0.25% control charges due to the fact a servicing fees to have handling your bank account such as sending you prompt intimations, issuing comments, taking tax permits, an such like. Regardless of if exemptions otherwise fee costs completely rely upon brand new bank’s policy.