There are many assumptions from the home loans, especially in the field of authorities home loans. It’s possible to normally believe that if for example the government try giving a good financial it is merely allowable to use a moderate, single-loved ones assets with this funds. It is Incorrect.

FHA home loans can be used to receive a multiple-equipment assets. These qualities is actually popular because you will not simply feel a resident, however you will can pay the financial which have substantially down repayments and construct collateral much faster.

How so it works is the fact that the borrower of your own FHA home loan often qualify for and get acknowledged to purchase a multi-device assets. This can be sometimes for a few systems (a great duplex), about three tools (good triplex), otherwise four units (a great fourplex). The essential units you have try four, together with head stipulation is you live-in certainly one of the new devices. The property should be the pri cannot be regularly buy investment property. You additionally, don’t matter future book costs as part of your latest income to possess qualifying purposes.

What type of advantages can you enjoy in using the brand new FHA mortgage for multiple-unit functions?

The benefit of buying a multiple-unit assets with FHA ‘s the low down payment dependence on 3.5%. Other financing apps generally like to see a more impressive downpayment getting a multiple-tool property.

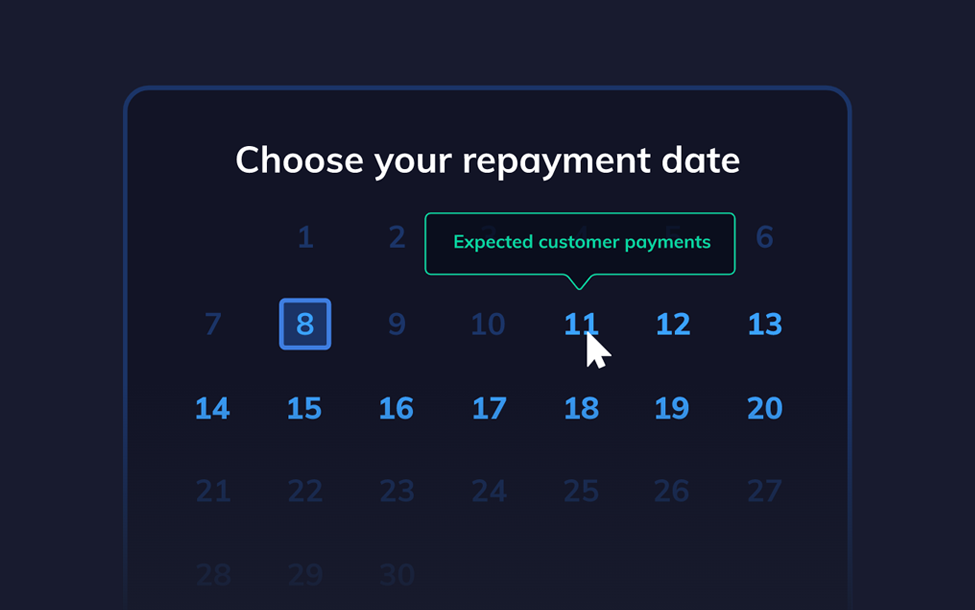

Other work with is the fact purchasing a multi-equipment will help counterbalance their mortgage repayments by renting out of the private student loans for students almost every other systems that aren’t filled from you. Your while the a citizen score a chance from the getting a property manager. The fresh local rental costs which can be gotten by the clients would be made use of to the settling your home loan or simply cutting your monthly with your own money can cost you.

If you like significantly more into the-breadth information about the brand new FHA financial, you could call our work environment at the (877)432-Loan (877-432-5626), otherwise send us a message within .

People with highest family members in their neighborhood ple you’ve got a triplex that have a couple empty gadgets. Your sibling close to his partner lost their flat because was are transformed into a flat. Today, your cousin along with his spouse is expecting and require extra space. You can rent out your own other systems into the family unit members, because you understand they are working, and you can be comfortable with the knowledge that you are linked to and accustomed their tenants. As long as the household professionals possess a ready lease contract in addition to their deposits, you are all set to seriously ensure that is stays on the relatives.

How will you go above and beyond to suit your tenants, whenever you are protecting disregard the?

Once the a property manager, you will not only feel maximizing your role, but you can also service your own clients from the permitting her or him create the credit history. By taking area regarding RentTrack program, your create tenants to pay lease on the web, and therefore transmits for your requirements in one to three working days. Credit bureaus Experian and you may Transunion commonly create the fresh tenant’s credit score, and RentTrack may also give you accessibility ScreeningOne. This can will let you consider record information on prospective otherwise established tenants. For additional information on RentTrack, you may want to call our office from the (877)432-Loan (877-432-5626) otherwise explore all of our web site’s chat function.

As financing often today become to own a multiple-device assets, another expectation would be that the brand new down payment fee to the FHA might possibly be high. Happy to you the three.5 % down-payment mediocre towards FHA home loan nonetheless stays.

Could there be any way locate a keen FHA financial to own a house with more than five systems?

The newest FHA, significantly less than Section (f), may support consumers to refinance or to get a beneficial multifamily strengthening of at least 5 home-based tools. This type of functions which were repaired or renovated over step 3 ages before the big date of home loan thought, otherwise don’t possess done bathrooms and you can kitchen areas, will never be acknowledged.

Unfortunately, we do not render FHA money on the over cuatro systems. When you are wanting more devices, you’ll want to come across a large financial company or financial which provides it.